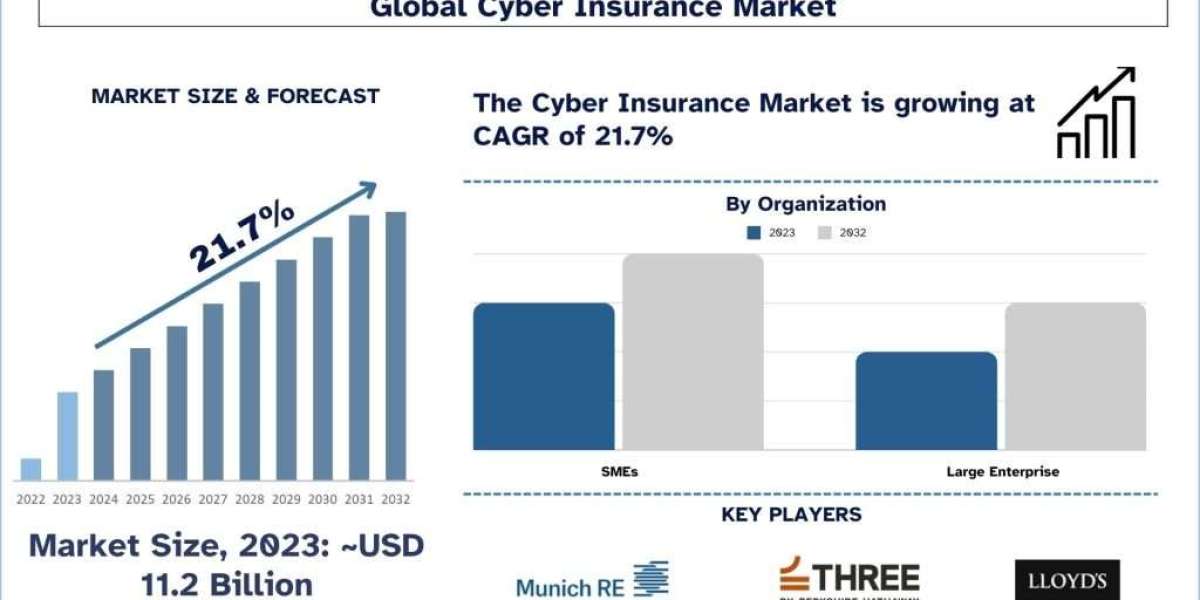

According to the UnivDatos Market Insights analysis, governments and regulatory bodies are imposing stricter data protection and privacy regulations, encouraging companies to secure cyber insurance. Furthermore, Incidents involving major corporations have highlighted the need for comprehensive cyber insurance policies. The Cyber Insurance Market was valued at USD 11.2 billion in 2023, growing at a CAGR of ~21.7% during the forecast period from 2024 - 2032 to reach USD billion by 2032. Cyber insurance Cybersecurity insurance or cyber liability insurance is a special insurance that provides a client financial protection against a loss for cyber threats or risks. Such events may include hacking of an organization’s data, theft of identity, and ransomware to system breakdown which affects business operations. The common risks that are covered by cyber insurance include the cost of data recovery, legal bills, public relations, and informing the affected parties.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=65258

Demand for Cyber insurance around the World

Cyber insurance has been rapidly increasing its demand worldwide due to the higher frequency and severity of cyber incidents. Recently, organizations such as government agencies, healthcare providers, financial institutions, and retail stores have become frequent targets of attacks or hackers due to their weak security.

There are several reasons as to why this demand is rapidly increasing. First, due to the COVID-19 pandemic, companies’ digitalization has been enhanced using digital platforms and cloud solutions. This shift has put organizations at a greater risk than before when it comes to being attacked hence the need for cyber insurance. Moreover, the increasing regulation around the world by jurisdictions including the European Union through the General Data Protection Regulation (GDPR) and the United States through the recently enacted California Consumer Privacy Act (CCPA) has made it mandatory to protect customer data. This means that companies may be left to bear the cost of a cyber-attack, including fines and reputational damage, increasing the need for cyber insurance coverage.

Application of Cyber Insurance Across Industries

Cyber insurance is becoming an essential component of risk management strategies across various industries, each of which faces unique cyber risks.

Below are some of the key sectors where cyber insurance is widely applied:

1. Healthcare

The sector that is most susceptible to cyber criminals’ break-ins is healthcare, as it processes a large amount of information about individuals. Cyber insurance is especially helpful for this sector as it helps companies cope with the loss that they suffer due to cyberattacks that involve confidential information about patients, the notification of those patients, lawyers’ fees, and further protection services for the victims of identity theft. Modern technologies and applications such as telemedicine, as well as the expansion of EHRs, have also served to heighten the necessity for comprehensive cyber insurance for healthcare organizations.

2. Finance

Another sector that has found itself on the radar of these hackers is the finance sector because of the large amount of valuable data that this sector holds in the form of customer’s personal and financial details. Cyber insurance helps financial institutions to offset possible loss because of data breaches, fraudsters, and regulatory penalties. Again, due to the high level of compliance demanded for this sector, cyber insurance assists financial institutions meet the legal demands on the protection of data and avoid attractive penalties.

3. Retail

Increased retail companies are engaging in electronic commerce hence becoming vulnerable to cyber risks including payment card fraud and data loss. Some key aspects of retail cyber insurance that are involved include costs of identification of fraud, costs related to credit checks, and costs related to public relations regarding trust to be restored after the incidence of the breach. Due to this emerging market of e-commerce in the retail business, the uptake of cyber insurance is likely to increase.

4. Manufacturing

Concerning cyber risk management, the manufacturing sector also requires more demands on cyber insurance, especially with the development of Industry 4.0 and the growth of connections in Industrial control systems (ICS). Cyber insurance can assist manufacturers prevent disruptions by ransomware attacks that can lead to the shutting down of operations and an enormous loss. It can encompass business disruption expenses, costs of getting operations back online and liabilities for sagging third-party data security.

5. Education

Today schools, colleges, and universities are becoming frequent victims of cyber criminals. In this sector, cyber insurance includes costs related to cybersecurity incidents that include violation of student and teacher information and the recovery of systems held to ransom by hackers. Since students are likely to spend their time in learning institutions adopting online and technology-based education systems, then the insurance for cyber risks is likely to increase.

Click here to view the Report Description & TOC https://univdatos.com/report/cyber-insurance-market/

Conclusion

Global trends indicate marked and continuous growth of the cyber insurance market fuelled by cyber threats and risks, regulatory environments as well as the expanding digitization of organizations. Though the price of cyber insurance depends on several factors, the value of its coverage against severe financial devastations cannot be overemphasized. It is imperative to reiterate that the nature of threats in cyberspace is continually changing and therefore so is the market for cyber insurance, with the insurance companies creating new and better products to counter the ever-emerging risks.

Related Report

Machine Vision Market: Current Analysis and Forecast (2024-2032)

Packaging Automation Market: Current Analysis and Forecast (2024-2032)

Causal AI Market: Current Analysis and Forecast (2024-2032)

Industrial Communication Market: Current Analysis and Forecast (2024-2032)

Sports Analytics Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website - https://univdatos.com/