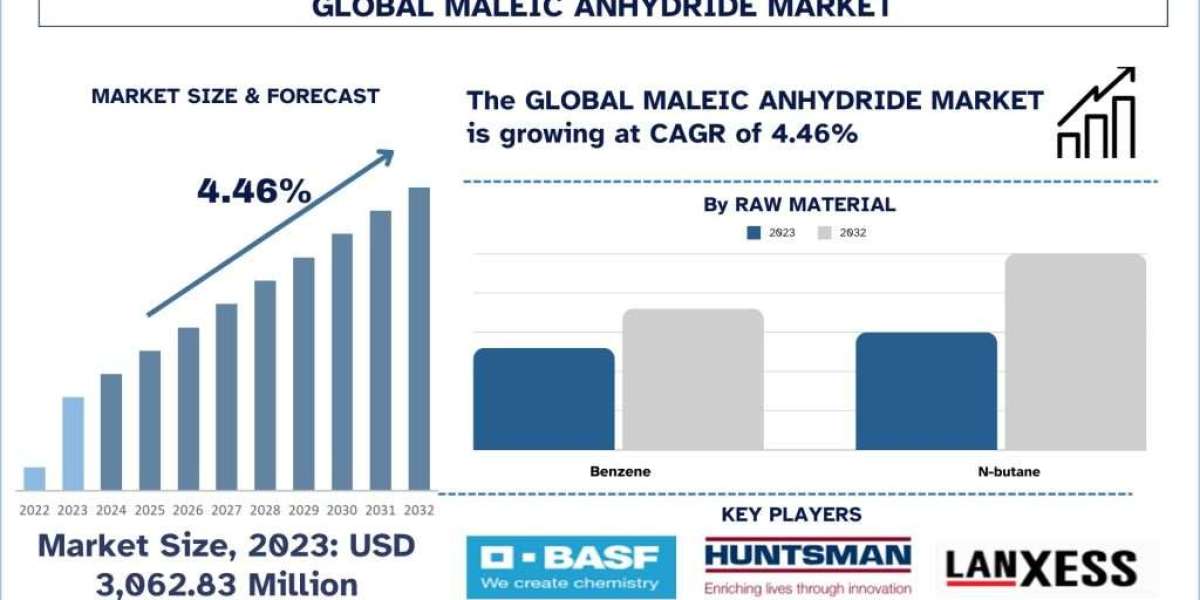

According to a new report by Univdatos Market Insights, the Global Maleic Anhydride Market is expected to reach USD 4,512.28 million in 2032, growing at a CAGR of 4.46%. The market is witnessing substantial growth driven by the increasing demand for unsaturated polyester resins (UPR), which are widely used in the construction, automotive, and marine industries.

Demand:

The market is experiencing solid growth due to the following reasons. First, the shifting of auto industry consumers’ demand to lighter vehicles with higher fuel efficiency has boosted the usage of unsaturated polyester resins (UPR), the primary end use of maleic anhydride. This demand is especially strong in the automotive and transportation sectors, as the use of UPR is due to its properties such as ultra lightness and ultra strongness. For instance, companies like BASF and Polynt-Reichhold, the producers of unsaturated polyester resins, have increased production of UPR to meet the growing demand of the automobile industry. In 2023, Polynt-Reichhold announced the opening of a new UPR production facility in North America to meet the increasing demand from the automotive industry.

Furthermore, the development of the construction industry in the economy and especially in the development of building environment, quality, and sustainable materials has also been instrumental in pushing the demand for UPR in the construction of buildings and infrastructures. The application of UPR in construction processes influences its increased durability and acts as a favorable material for environmental construction projects. In 2024, Arkema introduced a new range of nearly zero-emissions sustainable UPR products, proving that the construction sector is more conscious of sustainability and innovation.

Applications:

The maleic anhydride market is broad and used in many industries and fields. In the construction industry, maleic anhydride is crucial in producing unsaturated polyester resins (UPR), essential for creating durable, lightweight materials used in various building applications. In automotive applications, UPR derived from maleic anhydride is found in making parts with enhanced performance and is often used to reduce car emissions through increased fuel efficiency and vehicle weight reduction. This trend has been caused by car manufacturers’ insistence on developing fuel-efficient and lighter cars to comply with emission standards and customers' calls for better-performing automobiles. Such companies as BASF, which is an active participant in this market, shared information in 2023 that a new formulation of the UPR was undergoing construction that had better mechanical characteristics and lighter weight for automotive use.

Maleic anhydride has a critical role to play in synthesizing some of the chemical industry’s most demanded products, such as 1,4-butanediol (BDO), tetrahydrofuran (THF), and gamma-butyrolactone (GBL). These chemicals play a critical role in manufacturing many industrial chemicals and polymers. For instance, earlier this year, BASF planned to substantially increase the capacity of its BDO plant in China in 2024, with a target to fulfill the increasing requirements in the plastics and polyurethanes sectors. This expansion will underscore how maleic anhydride derivatives are critical in the global chemical system.

Request Free Sample Pages with Graphs and Figures Here https://univdatos.com/get-a-free-sample-form-php/?product_id=63816

Technological Advancements:

The market is experiencing rapid technological developments and significant efforts from top industry players in researching new and environmentally friendly production methods. A notable trend is the use of bio-based feedstocks for producing maleic anhydride. In 2023, Huntsman Corporation announced the development of a new bio-based maleic anhydride production process that reduces greenhouse gas emissions and reliance on fossil fuels.

Furthermore, companies are investing in advanced catalytic technologies to enhance the efficiency and yield of maleic anhydride production. In December 2022, LANXESS launched a new high-performance catalyst for maleic anhydride production that improves process efficiency and reduces operational costs.

Additionally, manufacturers are focusing on sustainable sourcing and green chemistry principles. In January 2023, Polynt-Reichhold Group introduced a sustainable production initiative to minimize environmental impact and promote renewable resources in maleic anhydride manufacturing.

Conclusion:

The global demand for maleic anhydride is increasing notably due to industries' shifting focus towards lightweight, durable, and sustainable materials. This report highlights that manufacturers are intensifying their efforts in innovation, driven by consumer needs, technological advancements, regulatory changes, and sustainability trends. With the growing emphasis on green chemistry and sustainable production practices, the maleic anhydride market is poised for significant transformation and growth in the coming years as companies strive to develop cutting-edge and eco-friendly solutions to capture market share.

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website -www.univdatos.com