Due to the thriving economy of several countries across the globe and the re-sultant surge in the demand for fossil fuels in order to meet the soaring re-quirements of electricity generation, domestic transportation, and other allied industries, the demand for centralizers and float equipment is expected to rise considerably in the coming years. According to the Organization of Petroleum Exporting Countries (OPEC), the global oil demand is predicted to increase from 95.4 million b/d in 2016 to 111.1 million b/d by 2040, thereby boosting the need for various upstream oil and gas production and exploration (EP) activities.

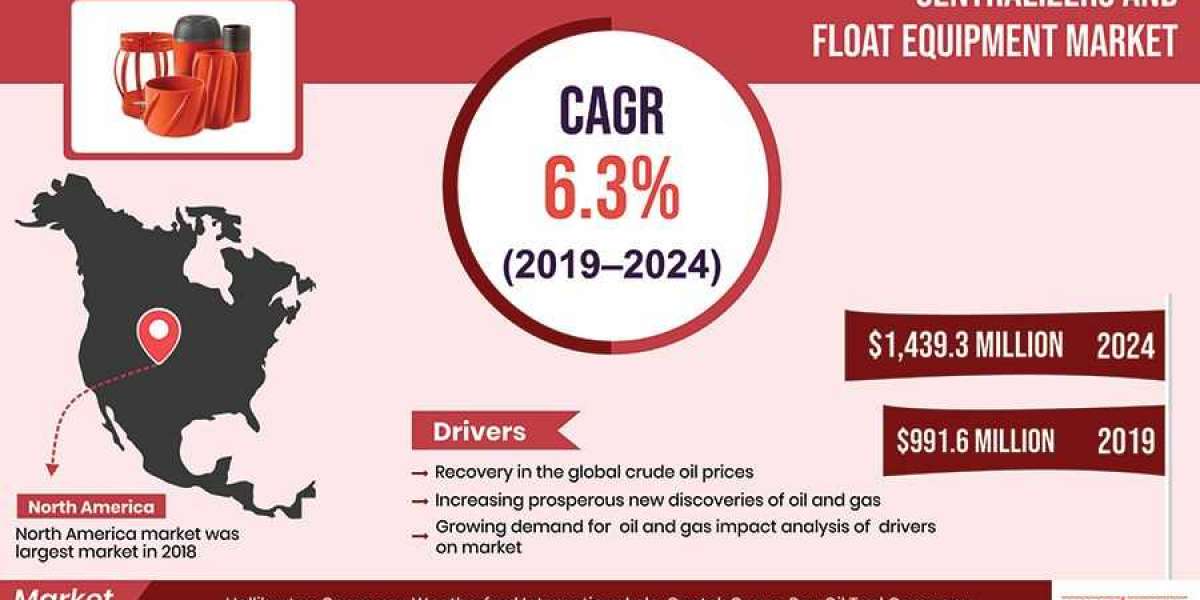

Due to the above-mentioned factors, the centralizers and float equipment market revenue is expected to increase from $991.6 million in 2018 to $1,439.3 million by 2024, with a CAGR of 6.3% during 2019–2024 (forecast period). These equipment are commonly used in various onshore and off-shore oil and gas production and exploration (EP) activities. Of these, the onshore applications recorded higher usage of this equipment in 2018, mainly on account of the higher number of EP activities in onshore fields (almost 80% of the worldwide oil and gas drilling activities).

Centralizers keep the sheath of the cement around the pipe determines uni-form, while float equipment decreases the tension on the derrick and stops the cement from ebbing into the well. Between the centralizers and float equipment, float equipment recorded higher volume of sales and revenue in 2018. This is mainly attributed to the soaring EP activities and the increasing need of preventing the back flow of cement slurry in well completion activi-ties. According to the oil and gas industry experts, the prices of crude oil are predicted to remain constant in the coming years, which will in turn, fuel the adoption of float equipment in the various EP activities during the forecast period.

The other major factors fuelling the surge in the demand for centralizers and float equipment are the recovery in crude oil prices since mid-2016 and the resultant increase in EP projects and activities by the major oil and gas pro-ducing companies across the world. For example, British Petroleum (BP) plc started Phase II of the Mad Dog oil field in the Gulf of Mexico after the recov-ery in crude oil prices, which significantly boosted the demand for centralizers and float equipment.

Geographically, North America recorded the highest demand for centralizers and float equipment in 2018. This is primarily ascribed to the fact that it ac-counts for the highest oil and gas production in the world, accounting for more than 20% of the worldwide production in 2018. Moreover, the region is also witnessing increasing investments by the major oil and gas producing companies on EP projects, which are expected to propel the growth of the centralizers and float equipment market in this region during the forecast period.

Therefore, due to the burgeoning demand for energy on account of the soar-ing global population level and flourishing economy of various countries espe-cially in the Asia-Pacific (APAC) region, and the increasing EP activities, the demand for centralizers and float equipment is expected to witness tremen-dous growth in the coming years.