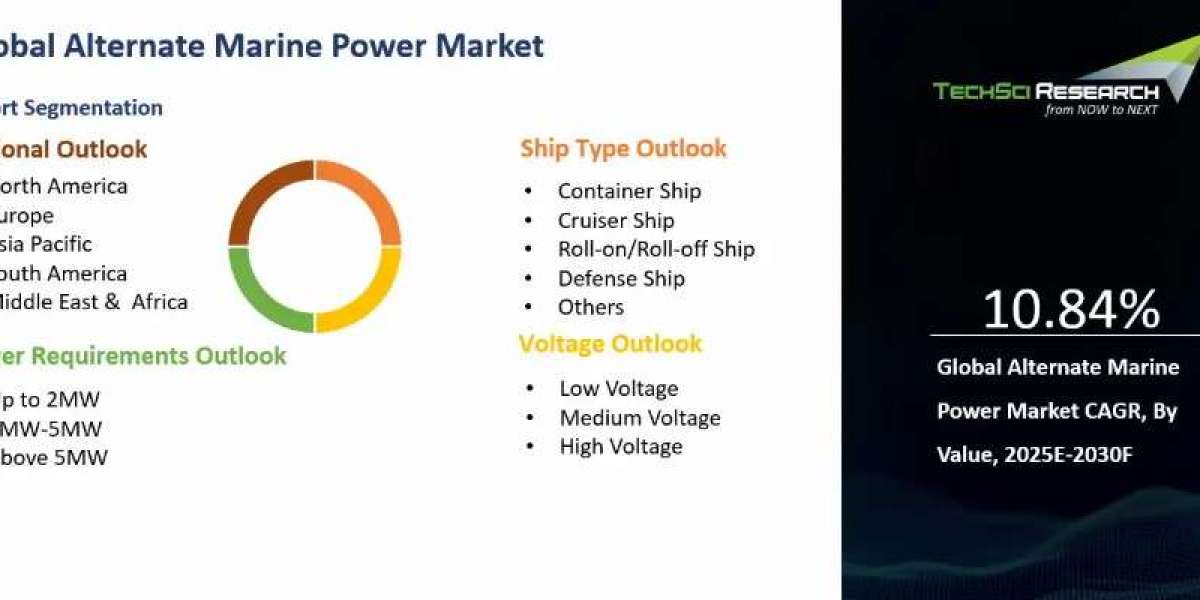

According to TechSci Research report, “Alternate Marine Power Market – Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2030F”, the Alternate Marine Power Market was valued at USD 400.64 Million in 2024 and is expected to reach USD 749.59 Million by 2030 with a CAGR of 10.84%. A key market driver for the Alternate Marine Power (AMP) Market is the growing global focus on reducing emissions from the maritime sector, fueled by increasingly stringent environmental regulations and international decarbonization commitments. As ports and shipping companies face mounting pressure to minimize air pollution and carbon emissions, the adoption of shore-to-ship power solutions is becoming a critical strategy for achieving sustainability goals.

Alternate Marine Power systems, also known as cold ironing or shore power, allow vessels to shut down auxiliary engines while docked and connect to land-based electrical grids, significantly reducing the release of nitrogen oxides (NOx), sulfur oxides (SOx), particulate matter, and carbon dioxide. This transition is being strongly supported by regulatory bodies such as the International Maritime Organization (IMO), which is enforcing stricter emission standards under its MARPOL Annex VI framework, along with regional regulations in North America, Europe, and Asia-Pacific that target emission control areas (ECAs). Additionally, rising public awareness of the environmental and health impacts of ship-generated emissions near ports and coastal urban areas is prompting governments to implement financial incentives and infrastructure investments to accelerate AMP deployment.

The increased availability of renewable energy sources in power grids further enhances the appeal of AMP systems, enabling ports to offer cleaner energy alternatives and support green port initiatives. Furthermore, the integration of AMP with smart grid technologies and energy management systems offers long-term operational efficiency and cost savings for ship operators, contributing to greater adoption. Port authorities and terminal operators are also recognizing the competitive advantage of providing AMP facilities, as more shipping lines prioritize sustainability in their logistics planning. Rapid growth in global trade volumes and containerized shipping activity, especially across major ports in Asia Pacific and Europe, is driving the need for scalable and future-ready AMP infrastructure.

Based on the Power Requirements, 2MW-5MW segment held the largest Market share in 2024. The 2 MW–5 MW segment in the Alternate Marine Power Market is experiencing robust momentum driven by a confluence of regulatory, operational, and economic factors, marking a pivotal moment for shipping companies to adopt shore power solutions capable of delivering mid-range power loads to large commercial vessels. As global marine emissions regulations become increasingly stringent—with ports enforcing zero‑emissions mandates and environmental zones tightening at berth—the ability to provide stable shoreline electricity within the 2–5 MW range is essential for medium‑sized container ships, cruise vessels, and Ro-Ro carriers to comply without running auxiliary engines.

This regulatory landscape is amplified by mounting pressure from stakeholders, including charterers, investors, and insurers, who demand demonstrable reductions in carbon emissions, particulate matter, and NOₓ output while vessels are docked. Technically, the 2–5 MW range aligns well with the typical power demands of vessels sized between 20 000 and 60 000 gross tons, making the modular and scalable designs in this segment especially attractive. These systems offer the flexibility to support evolving vessel power profiles as onboard systems and hotel load requirements grow more complex, allowing port operators to optimize infrastructure investment by deploying scalable power units capable of serving multiple vessel types.

Download Free Sample Report

https://www.techsciresearch.com/sample-report.aspx?cid=30298

Customers can also request 10% free customization in this report.

From a cost standpoint, the mid‑range 2–5 MW systems strike a compelling balance between capital expenditure and service coverage, making them cost‑effective for ports serving regional and short‑sea trade routes where full heavy‑duty installations (above 10 MW) would be over‑specification. The modularity inherent in this segment enables solutions that can be incrementally expanded, lowering initial system cost while preserving flexibility as traffic volumes increase. In parallel, digitalization and smart grid integration are elevating the value proposition of 2–5 MW shore power units—advanced energy management systems, predictive maintenance analytics, and real‑time load balancing tools help ensure optimal uptime and efficient energy utilization across vessels and shore infrastructure.

This trend is further boosted by the convergence of renewable energy sourcing (e.g. port solar or wind) and energy storage systems, enabling low‑carbon or carbon‑neutral shore power delivery tailored to mid‑range demands. On the financing side, many ports and terminal operators are leveraging green bonds, sustainability-linked loans, and government incentive schemes to de‑risk investments in these systems, reflecting their importance in decarbonization roadmaps and long‑term ESG strategies. Vessel operators are also forming partnerships and adopting business models such as port‑side power purchase agreements (PPAs) or capital‑as‑a‑service contracts, making 2–5 MW systems accessible even without upfront CAPEX.

Market growth in this segment is further propelled by the anticipated rise in short-sea shipping, cruise tourism in developing regional ports, and offshore support vessels, all of which predominantly fall within the mid-capacity power band. Finally, the global maritime ecosystem’s transition toward alternative propulsion and hybrid energy systems—spanning LNG, hydrogen, battery, and fuel-cell powered ships—creates complementary demand for versatile shore power infrastructure in the 2–5 MW range, capable of aligning with a range of onboard energy profiles. Collectively, these regulatory imperatives, economic drivers, scalable system design, smart energy integration, financing innovations, and alignment with vessel fleet evolution are positioning the 2 MW–5 MW alternate marine power segment as a strategic growth area within the broader decarbonized shipping infrastructure landscape.

Based on the region, Asia Pacific is the fastest growing region in the Alternate Marine Power Market, driven by rapid expansion of port infrastructure, increasing maritime trade, and growing environmental regulations targeting emissions reduction at major ports. Countries like China, Japan, South Korea, and India are investing heavily in shore power systems to support cleaner and more sustainable port operations. Regional governments are promoting green shipping initiatives and offering incentives to accelerate adoption of alternate power technologies. Additionally, the rise of electric and hybrid vessels in the region, along with the integration of renewable energy sources at ports, is further boosting market growth and innovation.

Major companies operating in the Global Alternate Marine Power Market are:

Siemens AG

ABB Ltd.

Cavotec SA

Schneider Electric SE

Wärtsilä Corporation

General Electric Company (GE Power)

Emerson Electric Co.

Power Systems International Ltd.

Blueday Technology AS

Nidec ASI S.p.A.

Download Free Sample Report

https://www.techsciresearch.com/sample-report.aspx?cid=30298

Customers can also request 10% free customization in this report.

“The Global Alternate Marine Power Market is expected to rise in the upcoming years and register a significant CAGR during the forecast period. The Alternate Marine Power Market is positioned for significant expansion as global decarbonization efforts and tightening maritime emissions regulations accelerate the transition toward cleaner port and vessel operations. Ports and shipping operators are increasingly investing in shore-to-ship power infrastructure to reduce reliance on onboard diesel generators during docking, thereby lowering fuel costs and emissions.

This shift is creating strong demand for advanced electrification technologies and system integration capabilities. The market is further supported by the growth of electric and hybrid marine fleets and the strategic push for renewable-powered port facilities. Innovations in automation and grid connectivity continue to unlock new commercial opportunities. Therefore, the Market of Alternate Marine Power is expected to boost in the upcoming years”, said Mr. Karan Chechi, Research Director of TechSci Research, a research-based global management consulting firm.

“Alternate Marine Power Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented, By Ship Type (Container Ship, Cruiser Ship, Roll-on/Roll-off Ship, Defense Ship, Others), By Voltage (Low Voltage, Medium Voltage, High Voltage), By Power Requirements (Up to 2MW, 2MW-5MW, Above 5MW), By Region, By Competition, 2020-2030F”, has evaluated the future growth potential of Global Alternate Marine Power Market and provides statistics & information on the Market size, structure, and future Market growth. The report intends to provide cutting-edge Market intelligence and help decision-makers make sound investment decisions. The report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in the Global Alternate Marine Power Market.

Contact

Techsci Research LLC

420 Lexington Avenue,

Suite 300, New York,

United States- 10170

Tel: +13322586602

Email: [email protected]

Website: www.techsciresearch.com