Market Overview

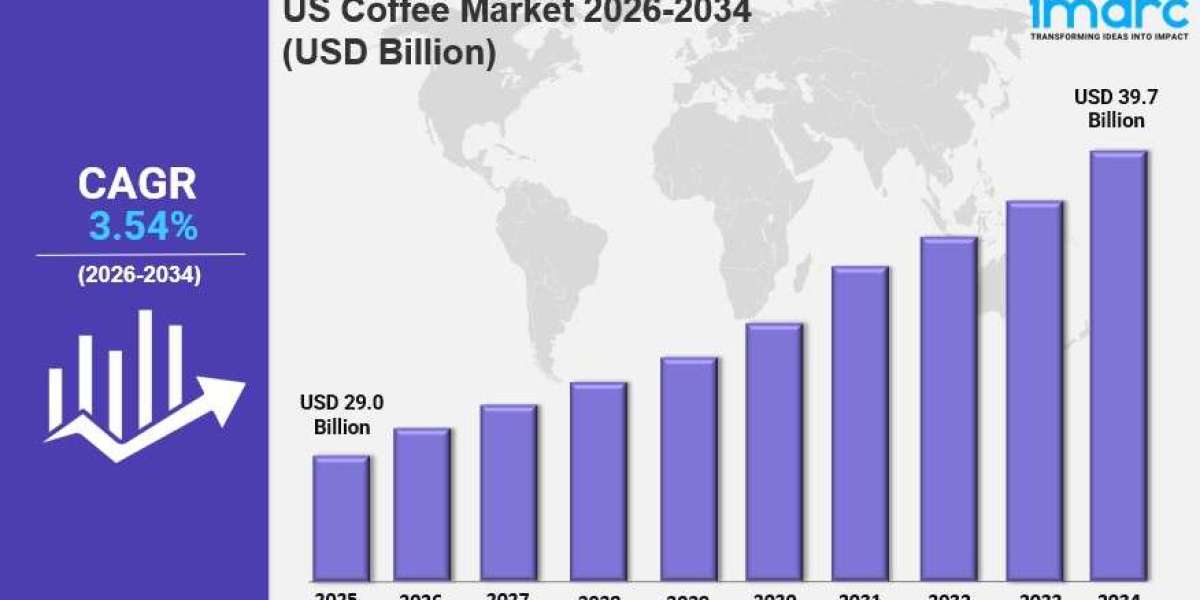

The US coffee market size was valued at USD 29.0 Billion in 2025 and is projected to reach USD 39.7 Billion by 2034, reflecting a CAGR of 3.54% during 2026-2034. Growth is fueled by rising demand for specialty and ethically sourced coffee, health-conscious beverage trends, and tech-driven innovations like smart brewing machines and coffee subscriptions.

Study Assumption Years

● Base Year: 2025

● Historical Year/Period: 2020-2025

● Forecast Year/Period: 2026-2034

US Coffee Market Key Takeaways

● Current Market Size: USD 29.0 Billion in 2025

● CAGR: 3.54% (2026-2034)

● Forecast Period: 2026-2034

● Increasing consumer demand for premium and specialty coffee products is a key growth driver.

● Growth of specialty coffee shops and convenience products like ready-to-drink coffee amplify market expansion.

● Health trends encourage plant-based milk alternatives, low-sugar, and functional coffee beverages.

● Technological innovations, including single-serve coffee pods and smart brewing machines, enhance consumer experience.

● Expanding online retail and subscription models boost accessibility to specialty and premium coffee.

Sample Request Link: https://www.imarcgroup.com/us-coffee-market/requestsample

Market Growth Factors

The U.S. coffee market is driven by increasing demand for premium, specialty coffee products, and rising consumption of coffee by the millennial population, and the rapid proliferation of specialty coffee shops across the United States, according to the report. Ready-to-drink coffee is convenient and drives market growth. Consumers demand products with higher quality from sustainable sources, and independent roasters and third-wave coffee shops respond to these demands via supporting transparency, sustainability and direct trade.

Health conscious customers drive the market because demand increases for coffee with functional ingredients like probiotics and immune boosters, and for the use of milk alternatives like almond or oat milk. Sugar reduces, demand increases for clean-label, naturally-derived ingredients and this leads toward innovative products like cold brew, nitro coffee, and superfood functional beverages.

Consumers have greater control over preparation methods with technological innovation, such as app-controlled temperature, time and strength or machines focused on specific flavor. Single serve coffee systems have changed the nature of coffee preparation in the home with greater speed, consistency and convenience. This is due to advances in precision grinders, increases in extraction and flavor quality, and the growth of online retail and subscription services.

Market Segmentation

Analysis by Product Type:

● Whole-bean

● Ground Coffee

● Instant Coffee

● Coffee Pods and Capsules

Descriptions:

● Whole-bean coffee appeals to enthusiasts valuing freshness and customized brewing experiences. It aligns with the premium nature of specialty coffees, emphasizing flavor and aroma preservation.

● Ground coffee offers convenience without compromising quality, providing a ready-to-brew option available in various blends and roast levels.

● Instant coffee is favored for its ease of preparation and affordability, suitable for on-the-go consumption and offices, with premium instant options emerging.

● Coffee pods and capsules provide quick, consistent single servings, gaining popularity for convenience and the expanding variety of flavors and eco-friendly options.

Analysis by Distribution Channel:

● Supermarkets/Hypermarkets

● Convenience/Grocery Stores

● Online Retail

● Others

Descriptions:

● Supermarkets/hypermarkets have a wide consumer reach and promote diverse coffee products with frequent promotions, supporting impulse purchases.

● Convenience/grocery stores offer easy access to key coffee brands for quick purchases, generally to meet last-minute consumer needs.

● Online retail is a growing channel providing convenience, greater product variety, subscription services, and access to specialty coffees.

● Others category includes additional distribution mechanisms not specified.

Regional Insights

The Northeast region stands out as a dominant coffee-consuming area due to dense urban populations and high income. Cities like New York and Boston foster strong coffee cultures with frequent cafe visits. The colder climate also supports higher hot coffee consumption. Demand here leans heavily on premium and specialty coffees, consistent with consumer preference for artisanal and high-quality products.

Recent Developments & News

● November 2024: Victor Allen's Coffee introduced a 60-count variety pack of premium coffee pods in the US featuring Colombia, Espresso, Mexico, and Brazil blends, crafted in Wisconsin.

● April 2024: NESCAFÉ launched two new instant coffee products in the US, Gold Espresso and Ice Roast, enhancing the instant coffee segment with specialty and cold dissolve options.

Key Players

● Danone North America Public Benefit Corporation

● Califia Farms LLC

● Fresh Roasted Coffee LLC

● Keurig Green Mountain Inc.

● Napco Inc.

● Nestle

● Starbucks

● The Eight O'Clock Coffee Company

● The J.M. Smucker Company

● The Kraft Heinz Company

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22117&flag=C

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302