The global MRD testing market is in the rapidly evolving and dynamic stage, which opens ample opportunities for diagnostic and life science companies. Also, companies that are already in the development phase for MRD tests are trying to match themselves with modern technologies in the market to improve the overall system of MRD testing, from diagnostic assays and kits development to commercialization.

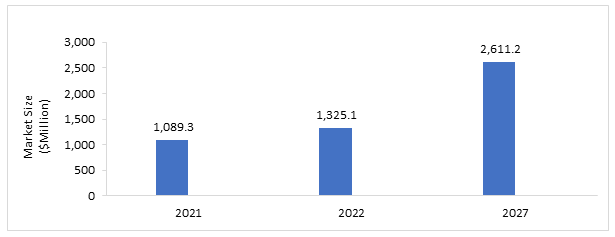

The minimal residual disease (MRD) testing market is projected to reach $2,611.2 million by 2027 from $1,089.3 million in 2021, at a CAGR of 14.53%. The market is driven by certain factors, such as the rising incidence of hematologic malignancies, increasing consumer awareness for tailored therapy, increasing research funding from the National Cancer Institute and increasing disposable income in emerging economies.

Impact

With an increased worldwide focus on treating hematological malignancies, the major market players are developing novel diagnostic tests, which are significantly impacting the growth of the MRD testing market. Diagnostic evolution in the form of companion diagnostics and liquid biopsy through molecular techniques such as PCR and NGS has enabled molecular diagnostic juggernauts to enter this market seamlessly. Following FDA approvals of clonoSEQ and Signatera, major companies are now looking to invest in the field of MRD, focusing primarily on the foundation laid for hematological malignancies. The market witnessed approximately 35 significant synergistic developments during the time period between January 2018 and May 2022.

Market Segmentation

Segmentation 1: by Technology

• Flow Cytometry

• Polymerase Chain Reaction (PCR)

• Next-Generation Sequencing (NGS)

• Other Technologies

Due to recent developments in molecular diagnostic technologies, the turnaround time and overall cost have been reduced with increased sensitivity and accuracy of results. Significant advances are being witnessed in the development of highly sensitive, quantitative, and multiplex assays. Some of the new technologies include NGS and low-cost PCR devices available in the form of multiparameter assays and multiplexing devices for MRD testing.

Segmentation 2: by Application

• Hematological Malignancy

• Solid Tumor

The global MRD testing market (by application) is broadly segmented into hematological malignancy and solid tumor applications. The global MRD testing market (by application) is dominated by hematological malignancy, which held a share of 94.39% in 2021.

Segmentation 3: by End User

• Hospital and Specialty Clinics

• Diagnostic Laboratories

• Research Institutions

• Other End Users

End users of the MRD market typically include hospitals and specialty clinics, research institutions, diagnostic laboratories, and others. Although hospitals and specialty clinics have been at the forefront of developing advanced technologies that incorporate several ancillaries for superior biological and chemical research, the applicability of MRD tests has been widespread among research institutions. Other end users, such as out-patient clinics and cancer clinics, also contribute significantly to the global MRD testing market.

Segmentation 4: by Region

• North America

o U.S.

o Canada

• Europe

o Germany

o Italy

o France

o U.K.

o Spain

o Rest-of-Europe

• Asia-Pacific

o China

o India

o Japan

o South Korea

o Australia

o Singapore

o Rest-of-APAC (RoAPAC)

• Latin America and Middle East

o Brazil

o Mexico

o Saudi Arabia

o Rest-of-Latin America and Middle East

• Rest-of-the-World (RoW)

In 2021, North America accounted for a share of 42.92% of the global minimal residual disease testing market. The segment is expected to reach $1,016.8 million in 2027 from $467.5 million in 2021 at a CAGR of 12.68% during the forecast period 2022-2027.

Recent Developments in the Global MRD Testing Market

• In November 2021, Palmetto GBA’s Molecular Diagnostics Program (MolDX) confirmed a local coverage determination that supported the Medicare coverage for clonoSEQ in patients with B-cell acute lymphoblastic leukemia (ALL), multiple myeloma (MM), and chronic lymphocytic leukemia (CLL) for monitoring minimal residual disease.

• In February 2021, Natera, Inc. and Personalis, Inc. partnered in the field of personalized oncology by combining Personalis’ NeXT tumor profiling and diagnostic products with Natera’s personalized ctDNA platform Signatera for treatment monitoring and molecular residual disease assessment.

• In May 2021, Invivoscribe, Inc. announced licensing of key software and two new MRD clinical services. The company’s LymphoTrack Enterprise Software supported high volume customers to meet ever-increasing testing demands.

• In October 2021, Inivata Limited, a subsidiary of NeoGenomics, Inc. entered a clinical collaboration with the Princess Margaret Cancer Center in Toronto, Canada, for the use of Inivata's InVisionFirst-Lung and RaDaR liquid biopsy assays in two separate studies.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Public companies include ICON plc, Bio-Rad Laboratories, Inc., Adaptive Biotechnologies Corporation, Sysmex Corporation, Quest Diagnostics Incorporated, Opko Health, Inc., NeoGenomics Laboratories, Inc., Natera, Inc., Laboratory Corporation of America Holdings, F. Hoffmann-La Roche, and Guardant Health. The private company profiled are ARUP Laboratories, Cergentis B.V., Invivoscribe, Inc., and Mission Bio, Inc.

Get Free Sample Report - https://bisresearch.com/requestsample?id=1307type=download

How can this report add value to an organization?

Technology/Innovation Strategy: The technology segment helps the reader understand the different technology based on MRD testing present in the market. Moreover, the study provides the reader with a detailed understanding of two different applications including hematologic malignancy and solid tumor.

Growth/Marketing Strategy: The global MRD testing market has seen major development by key players operating in the market, such as synergistic activities, product approvals, product launches and updates, mergers and acquisitions, business expansion and funding, and other developments (Medicare coverage). The favored strategy for the companies has been regulatory and legal activities along with product approvals to strengthen their position in the market.

Competitive Strategy: Key players in the global MRD testing market have been analyzed and profiled in the study. Moreover, a detailed competitive benchmarking of players operating in the global MRD testing market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

BIS Related Reports

Global Tumor Genomics Market

Global Hematologic Malignancies Testing Market