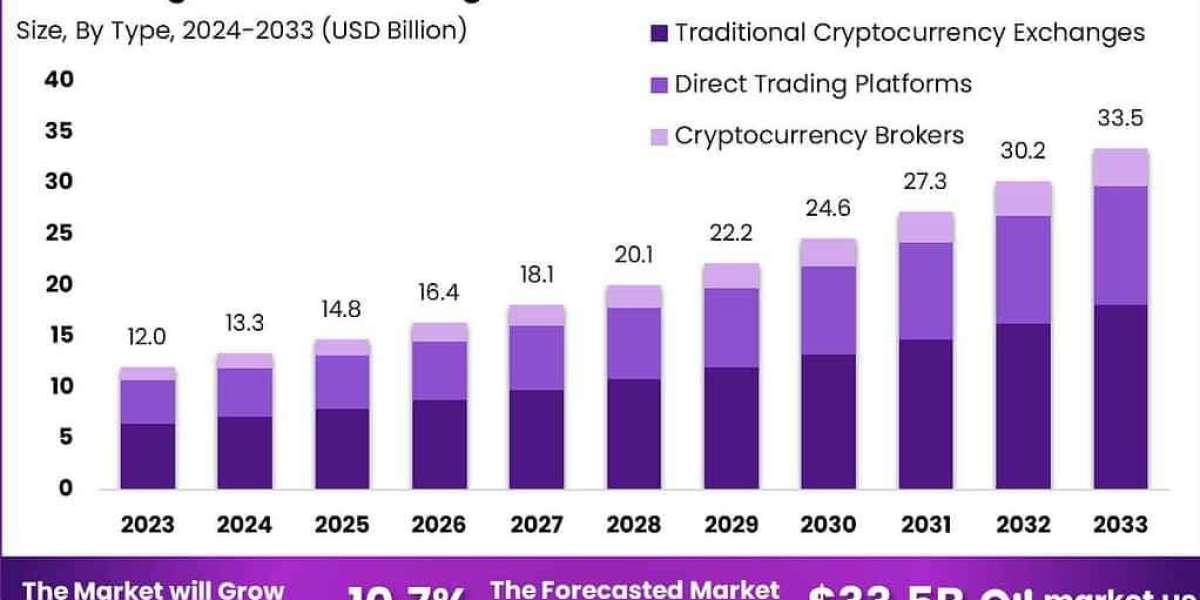

The Global Digital Asset Trading Platform Market is projected to reach USD 33.5 billion by 2033 from USD 12.0 billion in 2023, reflecting a CAGR of 10.7%. Rising institutional adoption, increased retail participation, and evolving regulatory clarity are driving demand. The market’s growth is significantly impacted by the expanding use of blockchain technology, tokenization, and cross-border digital payments. With North America generating USD 4.3 billion in 2023 and accounting for 36.3% of revenue, the region leads in innovation, adoption, and trading volumes, setting competitive benchmarks for other regions to follow in both infrastructure and user engagement.

Key Takeaways

Market size (2033): USD 33.5 billion

Market size (2023): USD 12.0 billion

CAGR (2024–2033): 10.7%

North America share (2023): 36.3%

North America revenue (2023): USD 4.3 billion

Dominant Market Position

North America maintains a leadership position in the global digital asset trading platform market, supported by robust technological infrastructure, deep liquidity pools, and a mature investment ecosystem. The presence of advanced blockchain frameworks, strong cybersecurity protocols, and active institutional investors drives the region’s dominance. Regulatory progress in key markets, combined with a surge in retail traders, accelerates adoption rates. High-frequency trading capabilities, stablecoin integration, and a mature derivatives market further strengthen its edge. This position is reinforced by extensive partnerships between trading platforms, fintechs, and traditional financial institutions, enabling a seamless bridge between fiat and digital assets for diversified global portfolios.

Technology Perspective

The market is being reshaped by blockchain innovations, AI-driven analytics, and decentralized finance (DeFi) integration. Trading platforms are increasingly leveraging machine learning for predictive market insights, fraud detection, and automated portfolio optimization. Advanced APIs and smart contracts are enabling interoperability across multiple exchanges, enhancing liquidity and execution speed. Tokenization of real-world assets, combined with Layer 2 scaling solutions, is reducing transaction costs and improving settlement efficiency. Security technologies such as multi-signature wallets, biometric authentication, and zero-knowledge proofs are enhancing user trust. The shift towards hybrid centralized–decentralized models is creating a more secure, transparent, and user-controlled trading environment for global investors.

Dynamic Landscape

The digital asset trading platform market is rapidly evolving, shaped by regulatory developments, market volatility, and emerging asset classes. Strategic collaborations, product diversification, and AI integration are redefining competition, while cross-border expansion and institutional adoption are fueling growth opportunities.

Drivers, Restraints, Opportunities, Challenges

Driver: Institutional adoption and blockchain innovation

Restraint: Regulatory uncertainty in emerging markets

Opportunity: Asset tokenization and DeFi integration

Challenge: Cybersecurity threats and fraud risks

Use Cases

Cryptocurrency spot trading

Derivatives and futures trading

Tokenized asset exchanges

Cross-border remittance services

Decentralized finance (DeFi) staking and lending

Key Players Analysis

Leading players in the market are focusing on expanding service offerings, enhancing security measures, and integrating advanced analytics to improve user engagement. Many are developing mobile-first platforms with real-time trading capabilities and AI-powered insights to attract both retail and institutional traders. Strategic partnerships with blockchain developers, payment processors, and custodial service providers are enabling smoother fiat-to-crypto transactions. Firms are also investing in compliance automation to align with evolving global regulations. Geographic expansion into Asia-Pacific and the Middle East is accelerating to capture high-growth markets. Additionally, diversification into NFTs, tokenized securities, and DeFi protocols is broadening revenue streams.

Recent Developments

Launch of AI-driven trading assistants

Integration of Layer 2 scaling solutions

Expansion of staking and yield-earning features

Cross-exchange liquidity partnerships

Enhanced institutional-grade custody solutions

Conclusion

The Global Digital Asset Trading Platform Market is on a robust growth trajectory, fueled by blockchain innovation, increased adoption, and diversified product offerings. While regulatory clarity and cybersecurity remain critical, technological advancements and institutional participation will drive sustained expansion through 2033.