Report Overview:

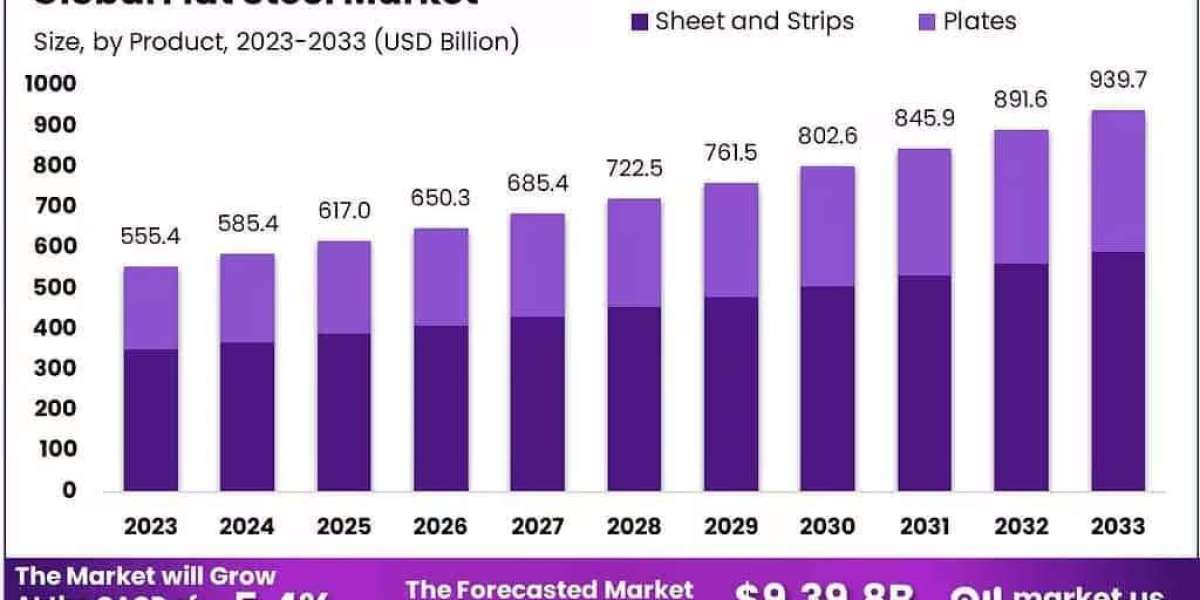

The global flat steel market is projected to grow significantly, reaching approximately USD 939.8 billion by 2033, up from USD 555.4 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 5.4% over the forecast period from 2023 to 2033.

Flat steel products such as hot-rolled coils, cold-rolled sheets, and coated steels play a vital role across various industries, including construction, automotive, shipbuilding, home appliances, and energy. The ongoing wave of urbanization, particularly in the Asia-Pacific and Middle Eastern regions, is driving a strong demand for materials that are durable, lightweight, and high in strength to support infrastructure and residential development.

At the same time, the global automotive industry is increasingly turning to advanced high-strength steel (AHSS) to manufacture lighter yet more robust vehicle bodies, which helps improve fuel efficiency and safety. Additionally, growing environmental awareness and commitments to net-zero emissions are pushing steel manufacturers to innovate with greener production methods. Technologies such as hydrogen-based reduction and the use of electric arc furnaces (EAFs) are gaining traction as sustainable alternatives to traditional steelmaking processes.

Key Takeaways:

- Market Growth Projection: The global flat steel market is poised to grow significantly, reaching an estimated worth of around USD 939.8 billion by 2033. This growth is anticipated at a CAGR of 5.4% from the USD 555.4 billion in 2023.

- Usage Diversity: Flat steel finds extensive applications across various sectors like construction, automotive, and mechanical equipment. Its versatility and ease of use contribute to its widespread adoption in these industries.

- Product Analysis: Sheets and strips constitute a significant portion (over 63.2%) of the flat steel market in 2023, especially in automotive and construction. Plates, accounting for 36.8%, are crucial in sectors requiring high tensile strength and resistance, such as bridges and shipbuilding.

- Material Types and Applications: Carbon steel dominates the market (over 49%), owing to its affordability and strength, particularly in construction and manufacturing. Stainless steel, valued for its corrosion resistance and strength, holds promise for vehicle structural components.

- Automotive Sector Impact: Nearly half of the total revenue in 2023 is attributed to the automobile segment. Flat steel’s use in vehicles significantly contributes to their strength and durability while maintaining relatively low costs.

![]()

Download Exclusive Sample Of This Premium Report:

https://market.us/report/flat-steel-market/free-sample/

Key Market Segments:

By Product

- Sheet and Strips

- Plates

By Material Type

- Carbon Steel

- Alloy Steel

- Stainless Steel

- Tool Steel

By Application

- Building & infrastructure

- Automotive and other Transport

- Mechanical equipment

- Other Applications

Drivers

The flat steel market is experiencing strong momentum due to several influential global trends. A major catalyst is the rapid urbanization and infrastructure development seen in emerging markets across Asia, Latin America, and the Middle East. Governments in these regions are channeling investments into large-scale infrastructure roads, bridges, airports, and energy facilities each requiring extensive quantities of flat steel, thereby creating sustained demand.

Another major driver is the expanding automotive industry. As global middle-class populations rise, so does the demand for cars. Flat steel particularly in sheet and strip form plays a vital role in vehicle manufacturing, being used in body panels, structural components, and safety systems. With a growing push for fuel-efficient and electric vehicles, automakers are adopting high-strength steel to reduce vehicle weight without compromising safety. This shift is supporting the growth of flat steel in auto manufacturing.

Innovations in steel processing have also expanded the market. New techniques like advanced pickling, laser-welding, and precision rolling have improved product performance while reducing waste. These advancements allow manufacturers in electronics, appliances, and industrial equipment to use lighter-gauge, high-performance flat steel products.

Sustainability initiatives are further strengthening flat steel's role in energy-efficient construction and green technology. The material is widely used in solar panel frames, storage tanks, HVAC systems, and energy-efficient appliances. Given that steel is among the most recycled materials globally, its circular nature also aligns well with growing demand for sustainable, low-carbon manufacturing.

Restraining Factors

Despite its advantages, the flat steel market faces several barriers. Volatile prices for raw materials such as iron ore and coking coal can significantly impact production costs. Market instability from geopolitical tensions or supply chain disruptions often translates to unpredictable input prices, making it harder for steelmakers to maintain stable profit margins or secure long-term contracts.

Environmental regulations also present challenges. Many countries are tightening emissions standards, especially around traditional blast furnace operations. Meeting these standards often requires costly upgrades to capture emissions or transition to cleaner technologies. In heavily regulated regions, these costs may slow expansion or even lead to closures of non-compliant plants.

The rise of alternative materials is another challenge. Aluminum and carbon fiber composites are gaining ground in the automotive and aerospace sectors due to their lightweight and corrosion-resistant properties. These materials, though more expensive, pose a competitive threat to flat steel, particularly where weight savings are a top priority.

Opportunities

Looking forward, the flat steel market has several promising growth avenues. The push for "green steel" is especially notable. Technologies such as hydrogen-based reduction and electric arc furnaces offer lower carbon emissions and are gaining support through government incentives and sustainability mandates. Early adopters of these methods are well-positioned to attract environmentally conscious customers and secure long-term contracts with OEMs focused on ESG goals.

There’s also increasing demand for specialized high-strength steel grades. These materials enable the construction of thinner yet stronger components, ideal for use in wind towers, pressure vessels, and next-generation electric vehicles. As demand for durable yet lightweight materials grows, flat steel producers who innovate in this space can access premium markets.

Modular construction is gaining ground across sectors like healthcare, data centers, and education, especially due to time and cost efficiencies. Flat steel is a core component in prefabricated panels and modules. Manufacturers that offer customized solutions for off-site construction can tap into this growing trend.

Additionally, aging infrastructure in North America and Europe presents a retrofit opportunity. Governments are allocating funds to modernize outdated bridges, pipelines, and transit systems. Galvanized and coated flat steel products are well-suited for these upgrades, presenting a long-term revenue stream for producers targeting the construction and public-works segments.

Trends

Several major trends are redefining the flat steel industry. One of the most transformative is the shift toward green steel. Hydrogen-based steelmaking and the use of electric arc furnaces (EAFs) are being piloted and scaled across Europe and North America. These low-emission technologies are essential as global automakers, construction firms, and governments place increasing importance on carbon reporting and sustainable sourcing. The demand for low-carbon steel is not just an environmental consideration it’s becoming a market expectation.

Simultaneously, the adoption of Advanced High-Strength Steel (AHSS) is transforming product design in the automotive and construction sectors. These steels offer superior strength-to-weight ratios, enabling safer, lighter, and more fuel-efficient designs. Their use also contributes to improved performance in seismic zones and other demanding environments.

Industry 4.0 is playing a central role in modern steelmaking. Smart factories are incorporating sensors, AI-driven quality control, and predictive maintenance tools to optimize output, reduce waste, and enhance product traceability. These improvements are helping steelmakers align with customer expectations for precision and reliability, especially in sensitive applications like aerospace or medical device manufacturing.

Modular construction and prefabrication are rising in popularity. Flat steel enables standardized and streamlined building processes, especially in sectors like healthcare and commercial construction where timelines are tight. This trend not only reduces labor and construction time but also boosts steel’s relevance in fast-paced urban development.

Market Key Players:

- АrсеlоrМіttаl

- Аnѕtееl Grоuр

- Ваоѕtееl Grоuр

- Ваоtоu Ѕtееl

- Веnхі Ѕtееl

- СЅС

- Еvrаz Grоuр

- Fаngdа Ѕtееl

- Gеrdаu

- Аnуаng Ѕtееl

Conclusion

Emerging economies across the Asia-Pacific region especially China and India continue to play a pivotal role in driving demand for flat steel. This growth is largely fueled by rapid industrial expansion, urban development, and large-scale infrastructure investments. Simultaneously, the global steel industry is undergoing a transformation, with increasing adoption of smart manufacturing and digital production systems. These innovations are helping producers improve operational efficiency, minimize waste, and better meet the evolving expectations of end users.

Although the market faces headwinds such as volatile input prices and rising energy costs, its versatility and essential role across industries help sustain long-term demand. Technological advancements are further reinforcing this momentum. The development of high-strength, lightweight steel, integration of Industry 4.0 technologies, and progress in surface treatment solutions are all enhancing product performance while supporting sustainability goals.

In addition, growing emphasis on recyclability, modular construction practices, and localized production strategies is helping the industry become more resilient and responsive. As a result, flat steel continues to serve as a critical material across sectors from automotive to construction and remains fundamental to the future of global industrial and urban growth.