Unlock Peace of Mind: The Ultimate Guide to Securing Your Crypto with a Cold Wallet

In the rapidly evolving world of cryptocurrency, the importance of security cannot be overstated. As more people invest in digital assets, the risks associated with keeping cryptocurrencies on exchanges have grown exponentially. Exchanges can be vulnerable to hacking and theft, leaving investors exposed to significant losses. This is where cold wallets come into play. A cold wallet offers a secure alternative for storing your cryptocurrency offline, effectively shielding your assets from online threats. This guide aims to help you understand the concept of cold wallets, their benefits, and the steps to purchase and set one up, ensuring that your digital investments remain safe and sound.

Understanding Cold Wallets

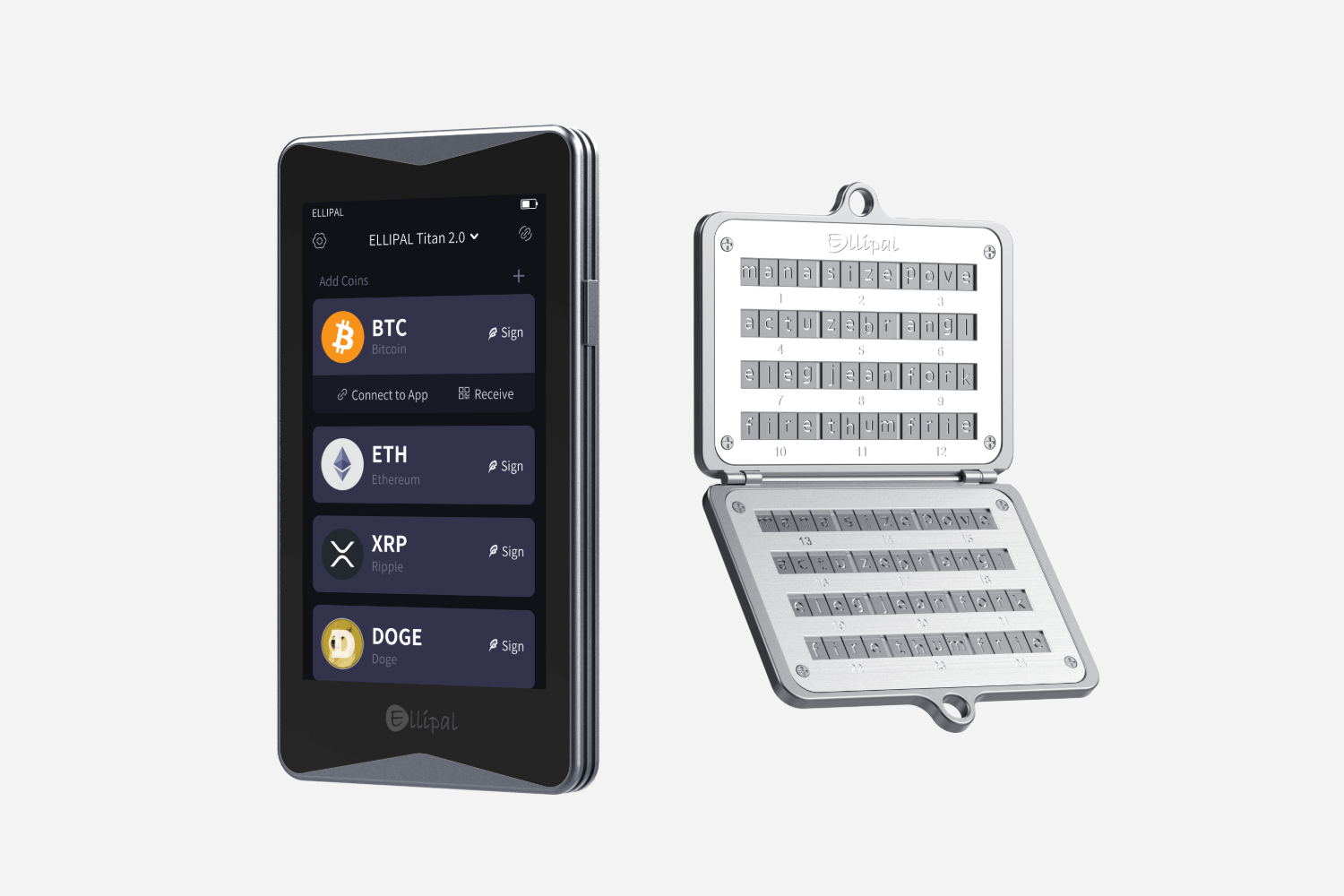

A cold wallet refers to a type of cryptocurrency storage that is not connected to the internet, providing a layer of security that hot wallets, which are online, cannot offer. Cold wallets come in various forms, primarily hardware wallets and paper wallets. Hardware wallets are physical devices that store your private keys offline, making it nearly impossible for hackers to access your funds remotely. On the other hand, paper wallets are simply printouts of your public and private keys, allowing you to store your cryptocurrency without any digital footprint. Understanding these options is crucial for anyone looking to secure their investments effectively.

Benefits of Using a Cold Wallet

One of the most significant advantages of using a cold wallet is enhanced security. By keeping your private keys offline, you are virtually immune to hacking attempts that target online wallets. Additionally, cold wallets protect your assets from malware, phishing attacks, and other online threats. Many investors find peace of mind in knowing that their cryptocurrencies are stored away from prying eyes and potential cybercriminals. For instance, a friend of mine, who had previously lost a substantial amount of money due to an exchange hack, switched to a cold wallet and has felt a newfound sense of security ever since. The offline storage not only keeps assets secure but also allows for easier management during volatile market conditions.

Factors to Consider When Purchasing a Cold Wallet

When it comes to purchasing a cold wallet, several factors should be taken into account. First, look for security features, such as encryption and two-factor authentication, which can significantly enhance the safety of your assets. Ease of use is another critical aspect; choose a wallet that aligns with your technical proficiency. Compatibility with various cryptocurrencies is also essential, especially if you hold a diverse portfolio. Backup options are crucial; ensure the wallet allows for easy recovery in case of loss or damage. Researching and reading user reviews can provide valuable insights into the reliability of different cold wallets, helping you make an informed decision.

How to Set Up Your Cold Wallet

Setting up your cold wallet is a straightforward process, but it requires careful attention to detail. First, begin with the initial setup, which typically involves connecting the hardware wallet to your computer and following the manufacturer's instructions. Once the wallet is initialized, create a strong password and write down your recovery phrase—this is crucial for restoring access to your wallet if needed. Next, transfer your cryptocurrency from exchanges to your cold wallet by generating a receiving address and executing the transfer. It's essential to double-check that the address is correct before completing the transaction. Lastly, maintain the security of your cold wallet by storing it in a safe place and keeping software updated to protect against any vulnerabilities.

Common Mistakes to Avoid

While cold wallets offer robust security, there are common pitfalls to be aware of. One major mistake is losing access to your recovery keys, which can result in permanent loss of funds. Always keep your recovery phrase in a secure, accessible location. Another frequent error is neglecting backups; failing to create multiple backups can be disastrous in case of hardware failure. Additionally, many users overlook the importance of keeping their wallet software up to date, which can expose them to potential security vulnerabilities. By being aware of these mistakes and taking proactive measures, you can ensure a smoother experience with your cold wallet.

Ensuring Your Crypto Security with Cold Wallets

In conclusion, securing your cryptocurrency assets with a cold wallet is a vital step in protecting your investments in the digital age. By understanding the various types of cold wallets, the benefits they offer, and the considerations to keep in mind when purchasing one, you can make informed decisions that enhance your financial security. Remember to follow best practices during setup and maintenance, and take steps to avoid common mistakes. With the right precautions, you can enjoy peace of mind knowing that your digital assets are safe and secure.