Unlock the Secrets: Why a Cold Crypto Wallet is Your Best Investment Yet!

In recent years, cryptocurrency has surged in popularity, captivating the interest of investors and technology enthusiasts alike. As individuals begin to explore the potential of digital currencies, the importance of securing these assets cannot be overstated. With the rising number of cyber threats and hacks in the crypto space, the need for a reliable storage solution has become paramount. This is where cold crypto wallets come into play. These wallets offer a secure method of storing cryptocurrencies offline, away from the prying eyes of hackers. This article targets those considering investing in a cold crypto wallet, guiding you through the benefits, features, and best practices to ensure that your digital assets are well-protected. So, whether you're a seasoned investor or just starting out, read on to discover why a cold crypto wallet could be your best investment yet!

Understanding Cold Crypto Wallets

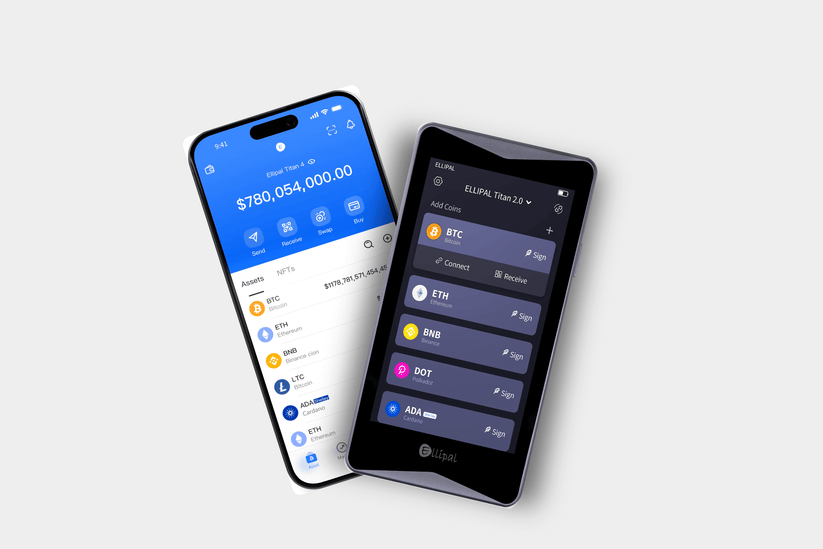

Cold crypto wallets are a storage solution designed to keep your digital assets offline, providing a stark contrast to hot wallets, which are connected to the internet. This offline storage method significantly reduces the risk of hacking and unauthorized access. Cold wallets can take various forms, including hardware wallets, which are physical devices that store your keys, and paper wallets, which involve printing your keys on paper. The technology behind cold storage focuses on keeping your sensitive information away from online threats, making it a favored choice among savvy investors. Understanding the differences between these wallet types can help you choose the best option for your specific needs, ensuring that your cryptocurrencies remain secure.

Why Choose a Cold Crypto Wallet?

There are numerous advantages to using a cold wallet for cryptocurrency storage. First and foremost, the security features of cold wallets are unparalleled. By keeping your assets offline, you are virtually immune to the hacking attempts that frequently target hot wallets. Additionally, cold wallets provide peace of mind, knowing that your investments are safe from the multitude of breaches reported in the crypto space. In fact, studies have shown that a significant percentage of cryptocurrency thefts occur due to vulnerabilities in online storage solutions. With a cold wallet, you can rest easy, knowing that your digital assets are secured against such threats, allowing you to focus on your investment strategies rather than worrying about potential losses.

Evaluating Your Needs: What to Look For

When selecting a cold crypto wallet, it’s essential to evaluate your needs carefully. Start by considering ease of use; a user-friendly interface is crucial, especially for those new to cryptocurrency. Compatibility with various cryptocurrencies is another important factor, as you may want to store multiple types of digital assets. Additionally, look for backup options that allow you to recover your wallet in case of loss or damage. Reading user reviews can provide valuable insight into the wallet's performance and reliability. Take the time to assess the features that matter most to you, ensuring that your chosen wallet aligns with your investment goals and comfort level.

Common Misconceptions About Cold Wallets

Despite their growing popularity, several misconceptions about cold crypto wallets persist. One common myth is that cold wallets are overly complex and difficult to use. In reality, many cold wallets are designed with user-friendliness in mind, making them accessible for individuals at all experience levels. Another misconception is that cold wallets are not easily accessible. While they are stored offline, many wallets offer straightforward methods for accessing your funds when necessary. Furthermore, some people mistakenly believe that cold wallets are completely foolproof against loss or theft. While they are significantly more secure, users must still practice caution and follow best practices to keep their assets safe. By clarifying these misunderstandings, potential investors can make more informed decisions regarding their cryptocurrency storage options.

Best Practices for Using a Cold Crypto Wallet

To maximize the benefits of a cold crypto wallet, it's essential to follow best practices for usage and maintenance. First, always store your wallet in a secure location that is protected from physical threats, such as theft or damage. Regularly back up your wallet to ensure that you can recover your assets in the event of loss. Additionally, keeping your wallet's firmware up-to-date is crucial for maintaining security; manufacturers often release updates to address vulnerabilities. Consider implementing two-factor authentication or a strong password to further enhance your wallet's security. By adhering to these best practices, you can safeguard your digital assets effectively and enjoy peace of mind in your investment journey.

Safeguarding Your Investment with a Cold Wallet

In summary, a cold crypto wallet is an invaluable investment for anyone serious about securing their digital assets. By understanding the differences between cold and hot wallets, recognizing the advantages of offline storage, and following best practices, you can protect your investments from the ever-present threats in the crypto world. As you evaluate your options and consider your investment strategies, keep in mind that the right cold wallet can provide not only security but also peace of mind. Take action today to safeguard your cryptocurrency and ensure a bright future for your investments.