Upon realizing the potential of this novel target, industry stakeholders have initiated several RD efforts focused on exploiting the use of CD47 as an effective biomarker for the diagnosis and treatment purposes.

Roots Analysis has announced the addition of “CD-47 Targeting Therapeutics Market, 2021-2035” report to its list of offerings.

In recent years, the focus of the research community has shifted towards the development of novel treatment modalities, such as T- cell immunotherapies, that exhibit high efficacy. CD-47, owing to its increased expression on the surface of cancer cells, has emerged as a cancer immune checkpoint biomarker.

To order this 190+ page report, which features 142+ figures, please visit https://www.rootsanalysis.com/reports/cd-47-targeting-therapeutics-market.html

Key Market Insights

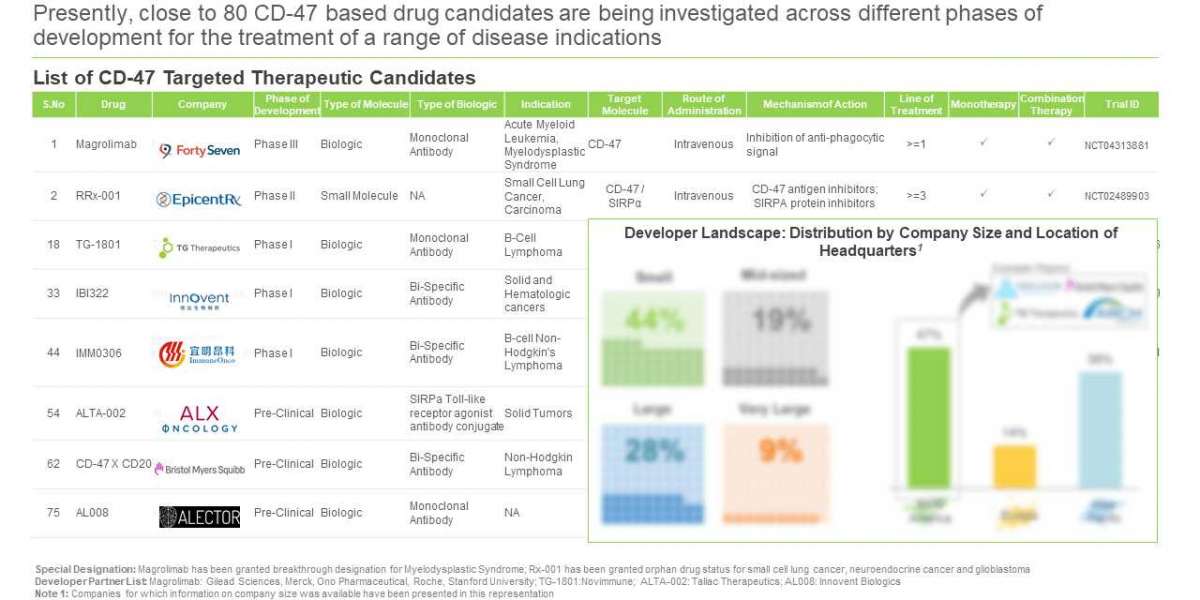

Over 75 CD-47 drug candidates are under various phases of development

52% of the pipeline candidates are currently in preclinical and discovery stages, while more than 48% therapies are being evaluated in clinical stages with most candidates being in early clinical stages (41.6%); 3.9% and 2.6% of clinical candidates being evaluated in phase II and phase III respectively.

~50 companies claim to be engaged in the development of CD-47 therapeutics, globally

Since 2015, 13 companies have been established in this domain. Further, around 44% of the industry stakeholders are small companies. In addition, majority (47%) of the CD-47 therapeutics developers are based in North America, primarily in the US.

Several clinical trials evaluating CD-47 targeting therapeutics have been registered worldwide

Clinical research activity, in terms of number of trials registered, is reported to have increased at a CAGR of 34.1%, during the period 2015-2020. Of the total, close to 13% of the studies have already been completed, followed by active trials that are actively recruiting patients (46.7%).

Partnership activity within this domain has increased at a CAGR of 25.7%, between 2016 and 2020

Clinical trial agreements emerged as the most popular type of partnership model adopted by industry stakeholders, followed by product development and commercialization agreements (25%), licensing agreements (25%), and services agreements (7.1%).

USD 3.3+ billion has been invested by both private and public investors

It is important to mention that, between 2016 and 2021, majority of the funding amount was raised through secondary offerings (46.5%), venture capital rounds (45%), IPO (15.6%) and debt financing (7.4%).

North America is anticipated to capture over 85% of the market share, by 2035

The market will be primarily driven by sales of CD-47 based therapeutics designed as biologics (over 60%), followed by those developed as small molecules (over 39%). Further, CD-47 based therapies targeting non-small cell lung cancer will capture the dominant share (23%) of the market (in terms of sales-based revenues); this trend is unlikely to change in the foreseen future.

To request a sample copy / brochure of this report, please visit

https://www.rootsanalysis.com/reports/cd-47-targeting-therapeutics-market.html

Key Questions Answered

- Who are the leading players engaged in the development of CD47 targeting therapeutics?

- Which are the key drugs being developed across early and late stages of development?

- Which companies are actively involved in conducting clinical trials for their therapeutics?

- What is the evolving trend related to the focus of publications related to CD47 targeting therapeutics?

- What kind of partnership models are commonly adopted by industry stakeholders?

- Who are the key investors in this domain?

- Who are the key opinion leaders / experts in this field?

- What are the evolving social media trends related to CD47 targeting therapeutics?

- What are the different initiatives undertaken by big pharma players for the development of CD47 therapeutics in the recent past?

- How is the current and future opportunity likely to be distributed across key market segments?

The financial opportunity within the CD-47 targeting therapeutics market has been analyzed across the following segments:

- Type of Molecule

- Biologics

- Small molecules

- Target Indications

- Acute Myeloid Leukemia

- Colorectal Neoplasms

- Diffuse-Large Cell Lymphoma

- Myelodysplastic Syndromes

- Non-Hodgkin Lymphoma

- Non-Small Cell Lung Cancer

- Oral Muscositis

- Ovarian Epithelial Cancer

- Small Cell Lung Cancer

- Key Players

- Key Geographical Regions

- US

- France

- Germany

- Italy

- Spain

- UK

- Australia

- China

- India

- Israel

The research includes detailed profiles of 10+ developers by (listed below); the profiles also feature an overview of the developer, its financial information (if available), recent developments and an informed future outlook.

§ Abpro |

§ ALX Oncology |

§ Apmonia Therapeutics |

§ Arch Oncology |

§ Aurigene |

§ Bristol Myers Squibb |

§ EpicentRx |

§ Forty Seven |

§ ImmuneOncia Therapeutics |

§ ImmuneOnco Biopharmaceuticals |

§ Innovent Biologics |

§ KAHR Medical |

§ Light Chain Bioscience |

§ Morphiex |

§ Trillium Therapeutics |

For additional details, please visit

https://www.rootsanalysis.com/reports/cd-47-targeting-therapeutics-market.html or email [email protected]

You may also be interested in the following titles:

- RAS Targeting Therapies Market, 2021-2031

- Squamous NSCLC Market, 2021-2031

- Peptide Therapeutics Market, 2021-2031

Contact:

Ben Johnson

+1 (415) 800 3415

+44 (122) 391 1091