Navigating the world of mortgages can feel overwhelming, especially in a bustling and competitive area like East London. Whether you're a first-time homebuyer, looking to remortgage, or exploring buy-to-let opportunities, having the right guidance is crucial. Finding a trusted mortgage advisor in East London can simplify this process, ensuring you get the best deal tailored to your needs.

Why You Need a Mortgage Advisor in East London

Securing a mortgage involves more than just choosing a lender. From interest rates to repayment terms, it’s a labyrinth of financial jargon and regulations. A mortgage advisor in east london brings local expertise, a clear understanding of the market, and access to exclusive deals. Their role isn't just transactional; it’s advisory and supportive, helping you navigate every step confidently.

What Does a Mortgage Advisor Do?

A mortgage advisor is a qualified expert who:

- Evaluates your financial situation to identify suitable mortgage options.

- Provides advice tailored to your unique circumstances.

- Facilitates applications with lenders, saving you time.

- Offers insight into current market conditions, especially in competitive regions like East London.

Whether you’re self-employed, on a fixed-term contract, or have a complex credit history, a skilled mortgage advisor can help.

The Benefits of Choosing a Local Expert

Working with a mortgage broker in East London offers unique advantages:

- Local Market Knowledge: East London is diverse, with property prices and lender preferences varying widely. A local advisor knows these nuances.

- Accessibility: Face-to-face consultations allow you to build trust and ask detailed questions.

- Connections with Local Lenders: Advisors often have established relationships with lenders in the area, potentially unlocking better deals.

How to Identify a Trusted Mortgage Advisor in East London

Choosing the right professional requires careful consideration. Look for the following traits:

Qualifications and Accreditation

Verify the advisor holds certifications such as CeMAP (Certificate in Mortgage Advice and Practice). They should also be registered with the Financial Conduct Authority (FCA).

Experience and Specialization

Find out how long they've been practicing and their areas of expertise. An advisor who regularly works with clients buying in East London will better understand local challenges and opportunities.

Independent vs. Tied Advisors

An independent mortgage broker in east london can access a wider range of lenders, increasing the chances of securing competitive rates.

Client Reviews and Testimonials

Search for reviews on trusted platforms or ask for referrals from friends and family. Genuine feedback is a great indicator of reliability.

Questions to Ask Your Mortgage Advisor

- What types of mortgages do you specialize in?

- Are you independent or tied to specific lenders?

- How do you earn your fees?

- Can you explain the entire process, from consultation to approval?

Red Flags to Avoid

Not every advisor is trustworthy. Be cautious if:

- They pressure you into decisions without thorough explanations.

- They lack proper accreditation or are vague about their qualifications.

- Their fees seem unusually low or high without clear justification.

Top Areas in East London for Property Investment

If you’re considering property investments, areas like Stratford, Shoreditch, and Canary Wharf offer excellent prospects. A local mortgage advisor in East London can help navigate the market dynamics in these hotspots.

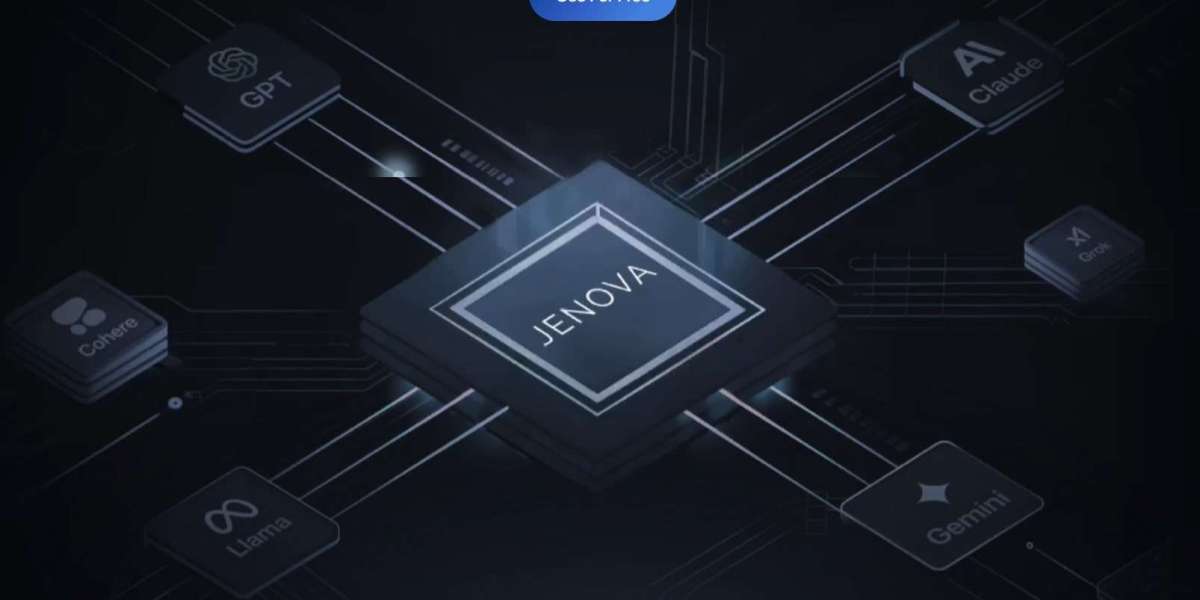

The Role of Technology in Mortgage Advice

Many advisors now use advanced software to compare mortgage options. While technology streamlines the process, personal consultations remain invaluable for tailored advice.

The Cost of Hiring a Mortgage Advisor

While some advisors charge a flat fee, others receive commission from lenders. Discussing and agreeing on fees upfront avoids surprises. In East London, expect fees to range from £300 to £1,000, depending on the complexity of your case.

Alternatives to Mortgage Advisors

Although you can approach lenders directly, this limits your options. Online comparison tools can help, but they lack the personal touch and expertise of a dedicated mortgage advisor in East London.

Conclusion

Finding the right mortgage advisor in East London is essential for a stress-free and successful property purchase. With the right professional by your side, you can navigate the complexities of the mortgage process confidently. Remember to verify qualifications, read reviews, and prioritize personalized advice. Whether you're buying your dream home or securing an investment property, expert guidance can make all the difference.