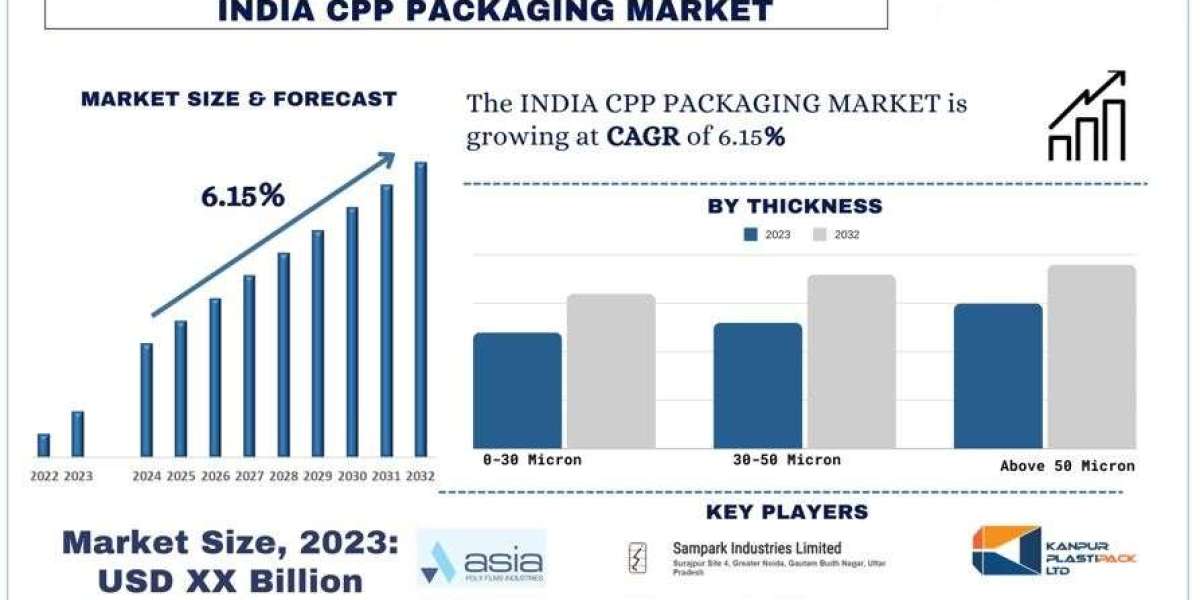

According to the UnivDatos Market Insights analysis, growing investments in the CPP packaging solutions for improving sustainable packaging solutions, the sector will surge in demand for the India CPP Packaging market, which will drive the growth scenario of the “India CPP Packaging market” report; the India market 2023, growing at a CAGR of 6.15 % during the forecast period from 2024 – 2032.

The packaging industry in North India has been one of the major markets adopting CPP Packaging due to the extensive availability of companies offering packaging solutions and services associated with them. Additionally, the region is also home to various food & beverages, automotive, pharmaceutical, and electronic goods manufacturing units that have assisted the growth of CPP packaging in the region.

CPP Packaging Market Overview in North India:

North India holds a sizeable market share of the demand for CPP packaging. The region is home to a sizable number of food processing, consumer goods, and non-alcoholic beverage production units. Major sectors constituting the food processing industry in India are processed fruits and vegetables, RTE/RTC, mozzarella cheese, processed marine products, edible oils, beverages, and dairy products. Additionally, the region is further anticipated to exhibit rapid growth due to government focus on establishing mega food parks, various cold chain projects, agro-processing clusters, and the creation and expansion of food processing and preservation capacities. Considering the upcoming plans, food processing, which is one of the key end-user industries for packaging, would further thrive in the region, subsequently promoting the demand for CPP packaging in the coming years. Many of the companies, such as Kanpur Plastipack CPP, Uflex Packaging Industry, Cosmo Films, etc., have their CPP manufacturing units in North Indian states near Delhi and Uttar Pradesh. With the rise in the demand for packaging solutions in the North region, many more CPP manufacturing units are anticipated to be established in the region, promoting market growth in the coming years.

There have been major implications due to the expansion of CPP packaging material among the various industries. Some of the notable implications across the various stakeholders and sectors are increased sustainability impact, enhanced market competition, shifting consumer preference towards product quality, etc. In line with this, many of the leading CPP Packaging manufacturing companies announced their plans to increase their production capability in order to tap the growth potential in the Indian market.

For instance, in 2022, Uflex Packaging Industry established its CPP packaging film plant with a total production capacity of 18,000 tons in Dharwad, India.

In another instance, in 2022, Cosmo Films added 3.89% to Rs 1767.30 crore after the company announced the setting up of a CPP film production line at Aurangabad with an annual rated capacity of 25,000 MT.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=62006

Growing Demand and Industry Trends:

The demand for CPP packaging is further supported by the rise of the automotive sector in India. CPP Packaging is used for manufacturing the internal parts of a vehicle such as a door panel, instrument panel, and trim parts. The CPP film provides a smoother and abrasion-resistant surface to the internal panels, enhancing both the aesthetic appeal and robustness of the components.

Recently, the usage of CPP packaging for the outer protection of vehicles has improved extensively. With the applications of withstanding UV, weather changes, rain, dust, and temperature shifts, the film has been used by customers to offer an additional layer of safety to the vehicle.

According to the Society of India Automotive Manufacturers (SIAM) the total sales of automotive the total sales of automobiles in India reached 2,38,53,463 in 2023 from 1,76,17,606 in 2021. This is around a 35% increase, which is further anticipated to rise in the coming years.

Considering the rising sales of automobiles as well as demand for protective veneering, the CPP Packaging would significantly improve in the segment and is anticipated to promote the market share in the coming years.

Conclusion:

In conclusion, the North India CPP Packaging market reflects a dynamic and evolving landscape supported by government investment, industry collaboration, and technological innovation. As the region continues strengthening its packaging industry and its effectiveness through investment increase, regulatory frameworks, and strategic partnerships, it is well-positioned to navigate challenges and capitalize on emerging opportunities in the packaging industry.

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website -www.univdatos.com

Related Chemical Market Research Industy Report:-

Chitosan Market: Current Analysis and Forecast (2024-2032)

Betaine Market: Current Analysis and Forecast (2024-2032)