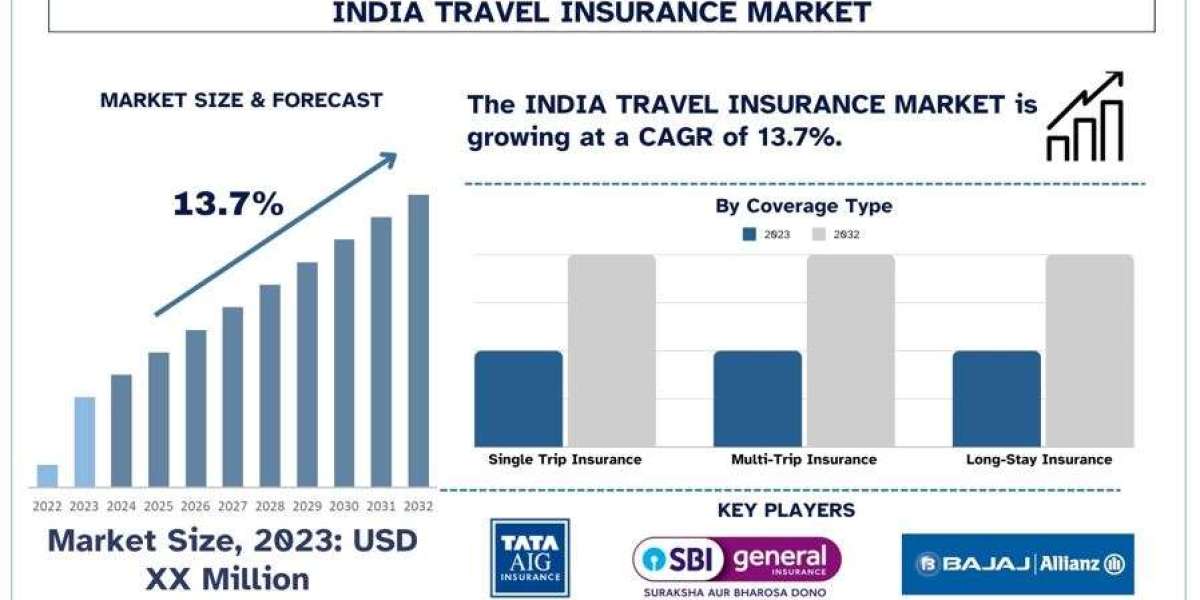

According to the Univdatos Market Insights analysis, increasing travel activity, rising awareness and education, and regulatory support from the government will drive the scenario of the Indian travel insurance market. As per their “India Travel Insurance Market” report, the market was valued at ~USD million in 2023, growing at a CAGR of about 13.7% during the forecast period from 2024-2032 to reach USD million by 2032. Travel insurance in India comes with many advantages that may greatly improve the journey by providing the insured with financial security. Here are some detailed benefits associated with travel insurance:

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=67899

· Medical Coverage: A large part of those advantages is medical emergency coverage. This entails hospitalization, evacuation, and repatriation, which effectively guarantees that travelers get the required medical attendance without having to pay heavens for the services.

· Trip Cancellation and Interruption: Travel insurance helps if a person needs to cancel or shorten their trip unexpectedly – like falling ill, having an emergency at home, or natural disasters striking while you’re on vacation.

· Loss or Delay of Baggage: The personal effects are mostly covered where a policyholder has lost, stolen, or had personal belongings such as luggage damaged. Delays are also catered for by policies that allow travelers to buy some items in case they miss connecting flights before their baggage does.

· Personal Liability Coverage: When a traveler gets into an accident and damages somebody else’s property or injures them, then travel insurance will take care of the legal costs and compensate the affected person preventing the traveler from losing too much money

· Emergency Assistance Services: Nearly all travel insurance companies have travel assistance services that work around the clock to help the traveler locate a doctor and get transportation or legal aid in case of an emergency.

· Coverage for Travel Delays: Losses resulting from flight delays, cancellations, or dissatisfaction caused by bad weather or other circumstances can be compensated for by reimbursement of extra accommodation, meals, and/ or transport costs.

· Coverage for Adventure Activities: Travel insurance policies are increasing including adventure sports and activities for example, trekking, skiing, or Scuba Diving which are famous among Indians.

· Flexibility and Customization: Most of the insurance policies offered by the insurance companies permit travelers to choose special coverage plans according to their requirements including coverage for that country or area, for the selected adventure activities, or for a certain period of time.

· Peace of Mind: The presence in the background of financial protection relieves a lot of stress and anxiety whilst traveling thus enabling one to make the most of his or her journey. Travel insurance also comes in handy whenever a traveler dies while on a trip because it pays for the expenses required for the transportation of the deceased’s body to India.

Recent Developments in the market are:

· In October 2024, ICICI Lombard, India's leading private general insurer, unveiled TripSecure+, an innovative AI-powered travel insurance solution that allows user to tailor their policy to fit their unique travel needs. They can easily adjust their coverage to include or exclude specific protection, ensuring that their policy works for their specific trip, whether it’s a relaxing beach getaway or a rugged outdoor adventure.

· In March 2024, TATA AIG General Insurance, which accounts for nearly a third of the country's overseas travel insurance premium, launched 'Travel Guard Plus', a travel insurance plan that provides coverage for up to one year through multiple or single trips.

Click here to view the Report Description & TOC https://univdatos.com/report/india-travel-insurance-market/

Conclusion

The benefits make travel insurance a useful product because it not only prevents people from losing their money but also brings some value to traveling which leads to higher adaptation and growth of the market.

Related Banking, Financial Services and Insurance Market Research Report

Insurtech Market: Current Analysis and Forecast (2024-2032)

Fintech Market in India: Current Analysis and Forecast (2024-2032)

India Motor Vehicle Insurance Market: Current Analysis and Forecast (2024-2032)

Private Health Insurance Market: Current Analysis and Forecast (2024-2032)

MENA Card Payment Market: Current Analysis and Forecast (2023-2030)

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website - https://univdatos.com/

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/