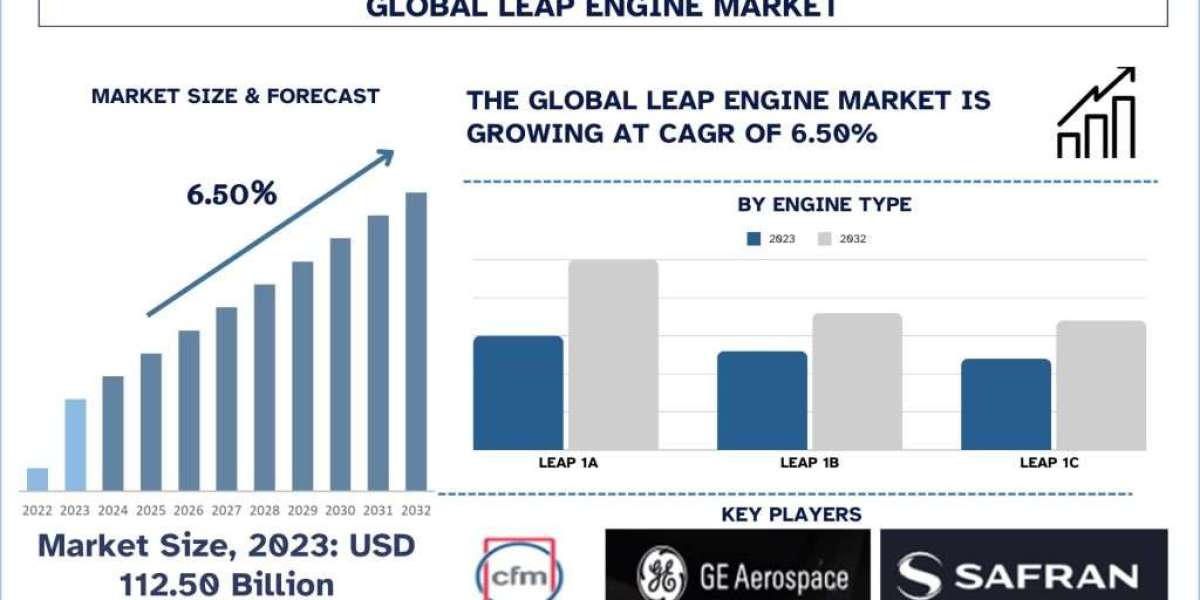

According to a new report by Univdatos Market Insights, the Leap Engine Market is expected to reach USD 198.29 billion in 2032 by growing at a CAGR of 6.50%. Leap Engine represents a significant development in the aerospace industry that focuses on advanced technology that enhances fuel efficiency by using turbofans. The engine came into existence in 2016, and quickly gained traction in the market. The engine is developed by CFM International, a 50-50 joint company between GE Aerospace and Safran Aircraft Engines. The engine is built and fits all variants of Airbus A320neo, Boeing 737 MAX, and COMAC C919 passenger jets.

KEY GROWTH DRIVERS:

The Leap Engine Market is expected to grow at a steady rate of around 6.50% owing to the growing demand for more reliable and fuel-efficient engines and growing environmental regulations. Leap engine offers greater fuel efficiency as compared to previous-generation engines. The leap engine has maintained 15% to 20% improved fuel efficiency to date, which is a major factor that attracts the airlines. Some of the additional factors that have propelled the growth of the market include the rapid growth in air travel, greater fuel efficiency, and the growing popularity of narrow-body aircraft. Global air travel has gained momentum in the last couple of years, especially after COVID-19, air travel has increased drastically which has boosted the demand for aircraft and consequently for leap engines. For instance, in 2024, according to the report published by ACI World, Global passenger traffic is expected to reach nearly 20 billion in 2042, double the 2024 projection. In 2052, global passenger traffic is expected to reach close to 25 billion, approximately 2.5 times the 2024 projection.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=67646

Latest Developments

· In July 2024, Nordic Aviation Capital (NAC), a global leader in aircraft leasing, today announced an order for ten LEAP-1A engines to power five Airbus A321neo family aircraft. The agreement also includes options for two additional LEAP-powered A321neo family aircraft.

· In March 2024, American Airlines, one of the world’s largest airlines finalized various agreements with CFM International for LEAP-1B engines to power the airline’s Boeing 737 MAX 8 and MAX 10 fleet. The agreement includes the purchase of spare engines, including a new 20-year service agreement covering America’s existing and new LEAP-1B engines.

· In February 2024, China Aircraft Leasing Group Holdings Limited (CALC) selected CFM International LEAP-1A engines to power an additional fleet of 20 Airbus A320neo and A321neo family aircraft, which are scheduled to begin delivery in 2026.

· In July 2024, Macquarie AirFinance finalized an agreement for 20 Boeing 737 MAX aircraft powered by 40 LEAP-1B engines. The company manages a fleet of more than 160 CFM-powered aircraft in service today, including both CFM56-powered Boeing 737NG and Airbus A320ceo family aircraft and LEAP-powered 737 MAX 8 and A320neo aircraft.

Commercial Segment Dominates the Market

The commercial segment dominated the market and is expected to experience significant growth in the forecast period owing to the rapid growth in air travel, greater fuel efficiency, and the growing popularity of narrow-body aircraft. Global air travel has gained momentum in the last couple of years, especially after COVID-19, air travel has increased drastically which has boosted the demand for aircraft and consequently for leap engines. Major airlines started modernizing their fleets, and as a matter of choice leap engines are their first choice due to greater fuel efficiency compared to other engines. For example, the leap engine can save fuel up to 15%-20%, which is highly attractive for commercial businesses. The increase in air travel due to the rising disposable income, growing tourism, recovery from post-pandemic, brand perception shift, and the growing partnership and alliances between major airlines have boosted the growth of narrow-body aircraft like the Airbus A320neo family and Boeing 737 MAX, which are the primary users of LEAP engines. Further, this has shown an imperative growth in low-cost carriers. For instance, in October 2024, VietJet Air ordered more than 400 LEAP-1B engines to power Boeing 737 MAX aircraft, including additional spare engines. These engines are expected to be delivered by 2025. Currently, the airline is operating 56 Airbus A321ceo and 17 A320ceo aircraft equipped with CFM56-5B engines. Therefore, with the growing air traffic globally, the demand for commercial aircraft has shown an imperative growth, and LEAP engines have become the first choice for airlines.

Explore the comprehensive research on report here:- https://univdatos.com/report/leap-engine-market/

Conclusion

The leap engine market is on pace for steady growth around the globe due to the growing aviation industry globally and the government regulation to decrease carbon-emission caused by aircraft, where leap engines produce less carbon compared to other engines. Additionally, the growing trend of narrow-body aircraft and the expansion of low-cost carriers has further boosted the demand for the market. Based on current technological innovation strategic partnerships between engine manufacturers and airlines will be crucial in sustaining growth in this dynamic market.

Related Aerospace and Defence Research Report

Aerospace Composites Market: Current Analysis and Forecast (2024-2032)

Advanced Air Mobility Market: Current Analysis and Forecast (2024-2032)

Drone Warfare Market: Current Analysis and Forecast (2024-2032)

Aircraft Auxiliary Power Unit Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website - https://univdatos.com/

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/