Injectable anticoagulants market is booming, with an estimated worth of US$ 6667.5 million in 2023 and a projected CAGR of 5.6% from 2024 to 2030, reaching US$ 9906.5 million by 2030.

To Know more about this report (Description, TOC and List of Tables and Figures) — Injectable Anticoagulants Market

This growth is fueled by several factors, including:

- Rising prevalence of chronic diseases: Conditions like venous thromboembolism (VTE), acute coronary syndrome (ACS)/myocardial infarction (MI), and atrial fibrillation (AF) are on the rise worldwide, driving demand for anticoagulants.

- Aging population: An increasing elderly population, more susceptible to blood clots, further fuels market growth.

- Technological advancements: Development of new, safer, and more effective injectable anticoagulants with targeted activity and reduced bleeding risks is another key driver.

Key Players:

The market is dominated by major pharmaceutical players like:

- Sanofi

- Genentech (Roche)

- Boehringer Ingelheim

- Aspen

- Pfizer

- Hepalink

- King-friend

- CSBIO

- Amphastar Pharmaceuticals

These companies compete fiercely through innovation, brand recognition, and strategic partnerships.

Drivers and Opportunities:

- Focus on personalized medicine: Development of anticoagulants tailored to individual needs and genetic profiles presents a significant opportunity.

- Growing awareness of VTE: Increased awareness of VTE prevention, particularly in high-risk groups like surgical patients, will boost demand.

- Expansion in emerging markets: Growing healthcare awareness and disposable income in developing regions like Asia Pacific offer lucrative growth potential.

Segmentation by Type:

- Low-molecular-weight heparin (LMWH): Dominant segment, valued for its efficacy and ease of administration.

- Unfractionated heparin: Traditional anticoagulant, facing competition from LMWH but still holds a significant market share.

- Fibrinolytics: Used to dissolve existing blood clots, but with higher bleeding risks.

- Others: This category includes newer anticoagulants like direct oral anticoagulants (DOACs) and novel antiplatelet drugs.

Segmentation by Application:

- Venous thromboembolism (VTE): Largest application segment, accounting for over half of the market.

- ACS/MI: A critical area for anticoagulant use in preventing further heart damage.

- Atrial fibrillation (AF): Increasing prevalence of AF drives demand for anticoagulants to prevent strokes.

- Others: This includes uses in deep vein thrombosis (DVT), pulmonary embolism (PE), and other thrombotic conditions.

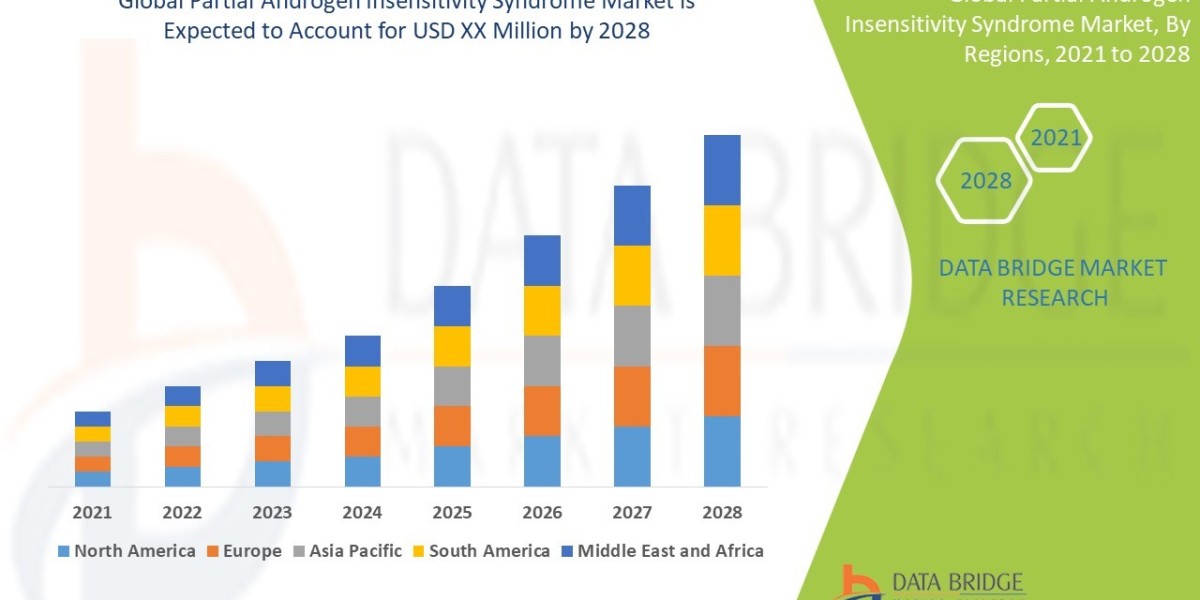

Segmentation by Region:

- North America: Largest regional market, driven by high healthcare spending and advanced medical infrastructure.

- Europe: Mature market with strong established players, but facing slower growth.

- Asia Pacific: Fastest-growing region due to a rapidly aging population and rising disposable income.

- South America and Middle East & Africa: Emerging markets with significant untapped potential.

Overall, the injectable anticoagulants market is poised for sustained growth in the coming years, driven by a combination of demographic trends, technological advancements, and increasing healthcare awareness.

Key players need to focus on innovation, personalized medicine, and expansion into emerging markets to capitalize on this promising opportunity.