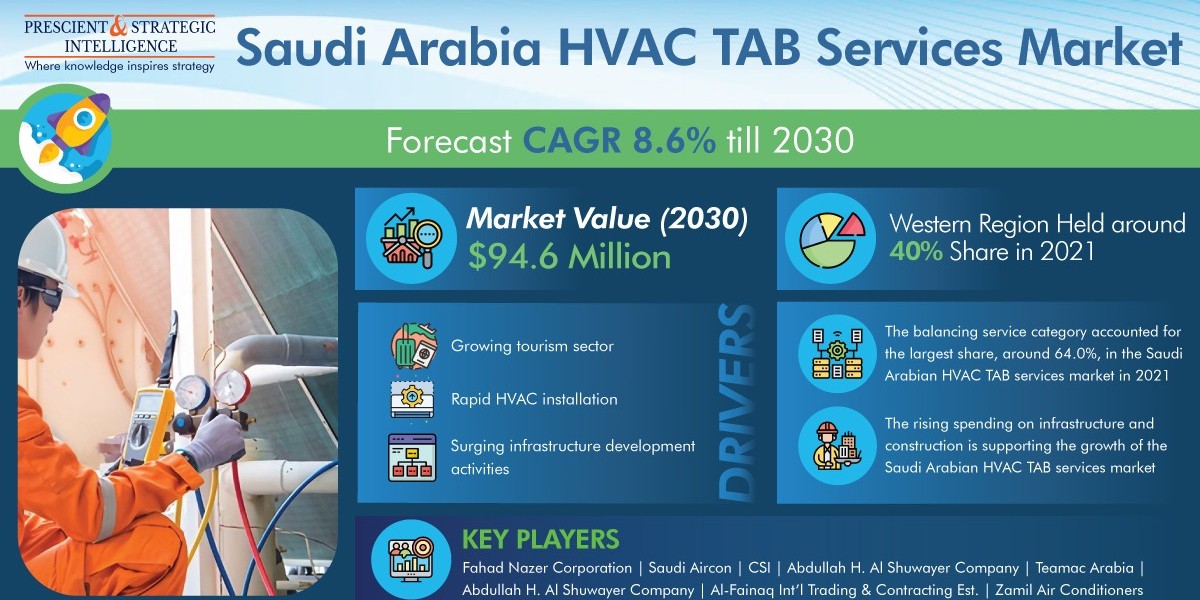

In 2021, the Saudi Arabian HVAC TAB services market was worth around USD 45.0 million, and it is projected to advance at an 8.6% CAGR from 2021 to 2030, hitting USD 94.6 million by 2030, according to P&S Intelligence.

This development can be credited to the quick HVAC installation, the rising tourism industry, and rising growth activities in the nation’s industrial and residential sectors. Furthermore, the requirement for such services is projected to increase significantly as a result of the strong development in the commercial construction sector of the nation.

In 2021, the balancing service category held the largest market share, approximately 64.0%, and the category is estimated to be dominant till 2030. This is mainly because air balancing plays a vital role in planning huge commercial construction projects, but the identical ideologies can simply be applied to individual houses or apartment complexes too.

HVAC problems that might be recognized via an air balancing inspection include perforated or damaged air ducts, blockages, loose duct joints, excessively long ductwork, undersized ducts, and ductwork with sharp turns.

On the basis of end uses, the commercial industry had the largest market share and is projected to grow at the highest rate in the coming few years. This is because of the increasing count of commercial buildings and offices and the rising hospitality industry.

Additionally, because of the constant development in foreign direct investment into Saudi Arabia, the rental standards of Grade A office spaces in Riyadh and Jeddah are constantly surging.

The western region held the largest market share, of approximately 40%, in 2021. This growth of the regional market can be attributed to the many key infrastructure growth projects in cities including Neom, Jeddah, Makkah, and Madinah.

Some of the infrastructure ventures are the USD 500.0-billion Neom city, USD 4.8-billion Jeddah downtown residential complex, and USD 8.0-billion Red Sea project.

Such expansions are being done against the framework of the Saudi Vision 2030, in which the government aims to expand its economy, which is presently reliant on the oil and gas sector. Furthermore, to this, the escalating travel and tourism industry is boosting the development of the services.

The increasing expenditure on infrastructure and construction is helping in the evolution of the Saudi Arabian HVAC TAB services market. The nation has planned a trillion-dollar investment in infrastructure projects targeted at expanding the economy beyond oil and gas and aligning itself as a worldwide hub for investment and logistics.

Hence, the quick HVAC installation, the rising tourism industry, and rising growth activities in the nation’s industrial and residential sectors are the key factors propelling the Saudi Arabian HVAC TAB services industry.