The adoption of automated medical technologies in developing countries is accelerating, driven by healthcare reforms, rising patient awareness, and a growing demand for infection control. Among these technologies, the Automated Endoscope Reprocessing Market holds significant untapped potential in emerging economies. As more hospitals and outpatient clinics adopt endoscopic procedures, the need for standardized, reliable, and scalable reprocessing methods becomes critical.

This article explores the current landscape of the Automated Endoscope Reprocessing Market in developing regions, highlighting both the opportunities for growth and the barriers that hinder widespread adoption.

Growing Demand for Endoscopic Procedures

Developing regions—especially in Asia, Africa, Latin America, and parts of Eastern Europe—are witnessing a steady rise in healthcare investments. Factors contributing to this growth include:

Government-backed universal health coverage schemes

Increasing availability of diagnostic services

Expansion of private and public hospitals

A shift from open surgeries to minimally invasive procedures

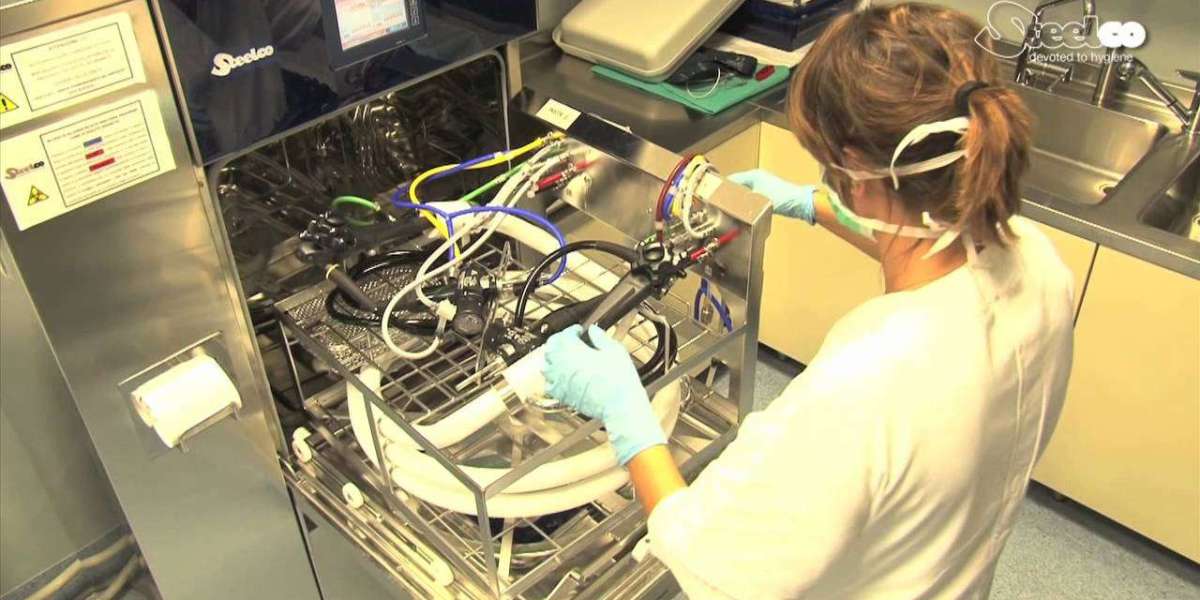

As these trends take root, the number of endoscopic interventions is growing. However, without proper reprocessing infrastructure, this growth poses a significant infection risk. That’s where automated endoscope reprocessors (AERs) present both a challenge and an opportunity.

Opportunities in Developing Markets

1. Healthcare Infrastructure Expansion

Developing countries are actively upgrading medical facilities and building new hospitals. This provides a natural entry point for modern technologies like AERs, especially in tertiary-care and specialty hospitals.

2. Rising Focus on Infection Control

The COVID-19 pandemic raised global awareness about hygiene and infection prevention. Healthcare facilities in emerging markets are increasingly prioritizing sterilization, and automated reprocessors are seen as reliable tools to mitigate infection risks.

3. Support from Global Health Organizations

Organizations such as WHO, UNICEF, and USAID often fund or support sterilization and disinfection upgrades in low-resource settings. Their involvement can speed up AER adoption, particularly in public hospitals.

4. Local Manufacturing and Partnerships

Manufacturers are exploring joint ventures and local assembly units to reduce costs and improve distribution. Regional partnerships also help adapt systems to local water quality, electricity standards, and training capacity.

5. Growing Private Healthcare Sector

Private hospitals and diagnostic centers are growing rapidly in countries like India, Brazil, Vietnam, Nigeria, and the Philippines. These institutions, focused on quality and patient safety, are more inclined to invest in automated systems.

Barriers to Market Penetration

Despite the potential, several barriers hinder the rapid growth of the Automated Endoscope Reprocessing Market in developing countries:

a. High Initial Costs

AER systems are capital-intensive, with models ranging from mid-tier to premium pricing. Smaller clinics often find it difficult to justify or finance such investments, especially where procedural volumes are low.

b. Limited Awareness and Training

In many facilities, staff still rely on manual cleaning due to a lack of exposure to automated solutions. Inadequate training can lead to underuse or misuse of advanced reprocessors.

c. Infrastructure Constraints

Clean water supply, stable electricity, and proper drainage are essential for AER operation. Many rural or semi-urban hospitals lack the infrastructure needed to support these systems.

d. Regulatory Gaps

Some developing countries lack comprehensive guidelines or enforcement mechanisms related to endoscope reprocessing. This weakens the incentive for facilities to upgrade from manual to automated systems.

e. Maintenance and After-Sales Support

Remote locations often face difficulties accessing technical service and spare parts. Delays in maintenance can lead to equipment downtime and reduce trust in automated systems.

Regional Snapshot

Asia-Pacific

India, China, Indonesia, and the Philippines are rapidly expanding their healthcare systems. India, in particular, shows strong growth potential due to public health initiatives like Ayushman Bharat and growing private hospital chains.

Africa

South Africa, Nigeria, Kenya, and Egypt are showing early adoption of automated medical technologies. However, infrastructure limitations and economic constraints remain challenges.

Latin America

Brazil, Mexico, and Colombia are leading AER adoption in the region, supported by large urban hospitals and increasing government focus on infection control.

Eastern Europe

Countries like Poland and Romania are modernizing healthcare facilities with EU-backed funds, offering new avenues for AER market penetration.

Strategies to Overcome Barriers

Manufacturers and stakeholders can support adoption in developing regions through the following approaches:

Offer flexible pricing models, such as rentals, lease-to-own, or financing packages

Design compact, energy-efficient, and water-saving systems for facilities with limited infrastructure

Establish training centers and mobile support teams to build user competence and trust

Partner with local distributors for better service and maintenance coverage

Develop multilingual interfaces and regional customization to improve accessibility

Some companies are also introducing semi-automated systems as transitional solutions for facilities unable to immediately adopt full AER capabilities.

The Road Ahead

While the road to full automation in endoscope reprocessing may be longer in developing countries, the momentum is clearly building. With the right combination of policy support, private investment, and technological adaptation, the Automated Endoscope Reprocessing Market can thrive in these regions.

As awareness spreads and global health priorities increasingly emphasize sterilization, developing countries will become critical to the future growth and geographic expansion of the market.

Conclusion

Developing regions represent a dual narrative in the Automated Endoscope Reprocessing Market—one of immense potential and real-world challenges. While barriers such as infrastructure and cost persist, growing demand for safer, more efficient healthcare practices is accelerating the adoption of automated systems.

By addressing affordability, accessibility, and education, market players can unlock new growth opportunities while improving global standards in infection prevention and patient care.