In the dynamic world of mutual fund investments, investors' banking preferences can change over time. Many Mutual Fund Distributors (MFDs) encounter situations where their clients wish to update bank details after registering on the Bombay Stock Exchange (BSE) platform. Traditionally, modifying bank information post-registration posed challenges. However, with the best mutual fund software solutions, this process has become streamlined and efficient.

Understanding the Need for Bank Detail Modifications

Investors may need to change their bank details linked to their mutual fund investments for various reasons:

● Relocation: Moving to a new city might necessitate switching to a local bank.

● Enhanced Banking Services: Opting for banks offering better online facilities or rewards.

● Account Security: Upgrading to banks with advanced security features.

● Simplified Transactions: Consolidating multiple investments into a single bank account for easier management.

Regardless of the reason, ensuring that bank details are current is crucial for seamless transactions and effective management of mutual fund investments.

How Software Eases Bank Detail Modifications

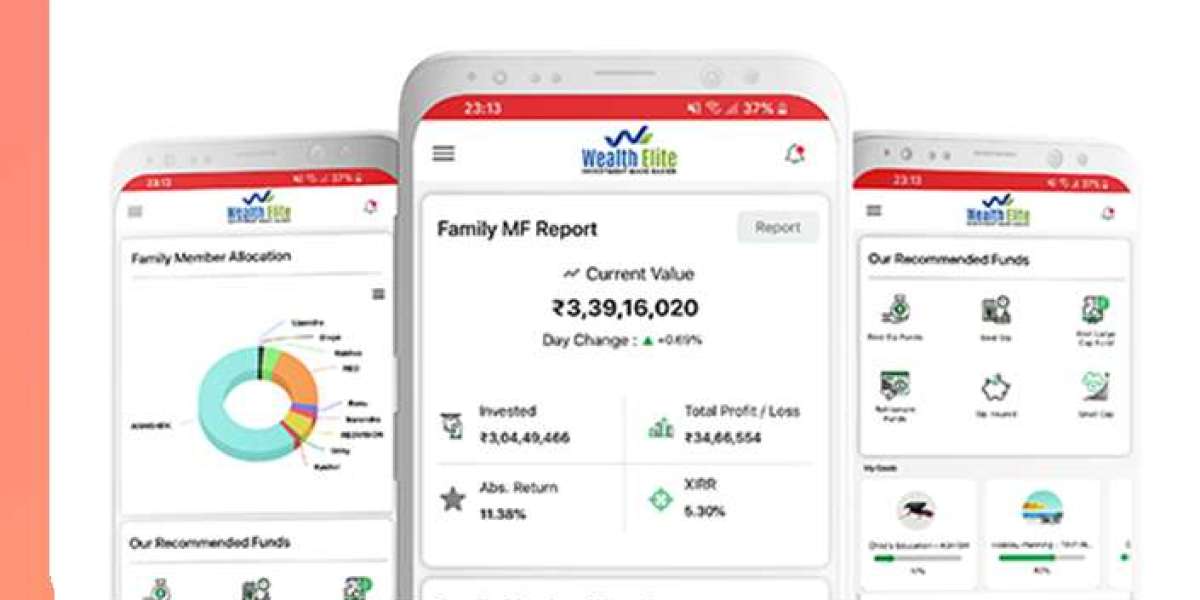

A user-friendly platform like the best mutual fund software in India helps manage client transactions and data efficiently. One of its standout features is the ability to update bank details for BSE-registered users, even after the initial registration.

For Investors Without an Approved Mandate

Investors who haven't set up an approved mandate can directly modify their bank details through the platform. The steps are straightforward:

1. Log In: Access the dashboard using your credentials.

2. Navigate to Bank Details: Locate the section to update your registered bank account.

3. Update Bank Details: Enter the new bank information, ensuring accuracy.

4. Save Changes: Confirm and save the updated details.

This process ensures that future transactions are directed to the correct account without any hitches. MFDs can assist investors by providing guidance on where to update their bank details.

For Investors With an Approved Mandate

For investors who already have an approved mandate, an additional step is required before updating bank details:

Step 1: Delete Existing Mandate

● Access Mandate Details: Within the investor's profile, locate the section detailing approved mandates.

● Initiate Deletion: Select the mandate linked to the bank account to be changed and follow the prompts to delete it.

● Confirm Deletion: Ensure that the mandate is successfully removed from the system.

Step 2: Update Bank Details

● Enter New Bank Information: Input the updated bank account details as described earlier.

Step 3: Create a New Mandate

● Generate New Mandate: After saving the new bank details, initiate the process to create a new mandate.

● Obtain Approval: The new mandate will undergo an approval process, which may take up to 48 hours.

MFDs can assist by informing investors about these steps and ensuring they complete the process correctly. However, the actual modifications must be done by the investors themselves.

Benefits for MFDs and Their Investors

The capability to modify bank details through the software offers significant advantages:

● Enhanced Flexibility: Investors can update their banking information as needed, accommodating life changes or personal preferences.

● Operational Efficiency: MFDs can manage multiple client updates simultaneously, reducing administrative workload.

● Reduced Errors: Automated processes minimize manual entry errors, ensuring accuracy in transactions.

● Improved Client Satisfaction: Quick and hassle-free updates lead to a better client experience, fostering trust and loyalty.

Conclusion

In the evolving landscape of mutual fund investments, adaptability and efficiency are paramount. The software's robust features empower MFDs to manage client bank details effectively, ensuring seamless transactions and enhanced client satisfaction. By leveraging such advanced software solutions, MFDs can navigate the complexities of bank detail modifications with ease, keeping pace with the dynamic needs of investors.