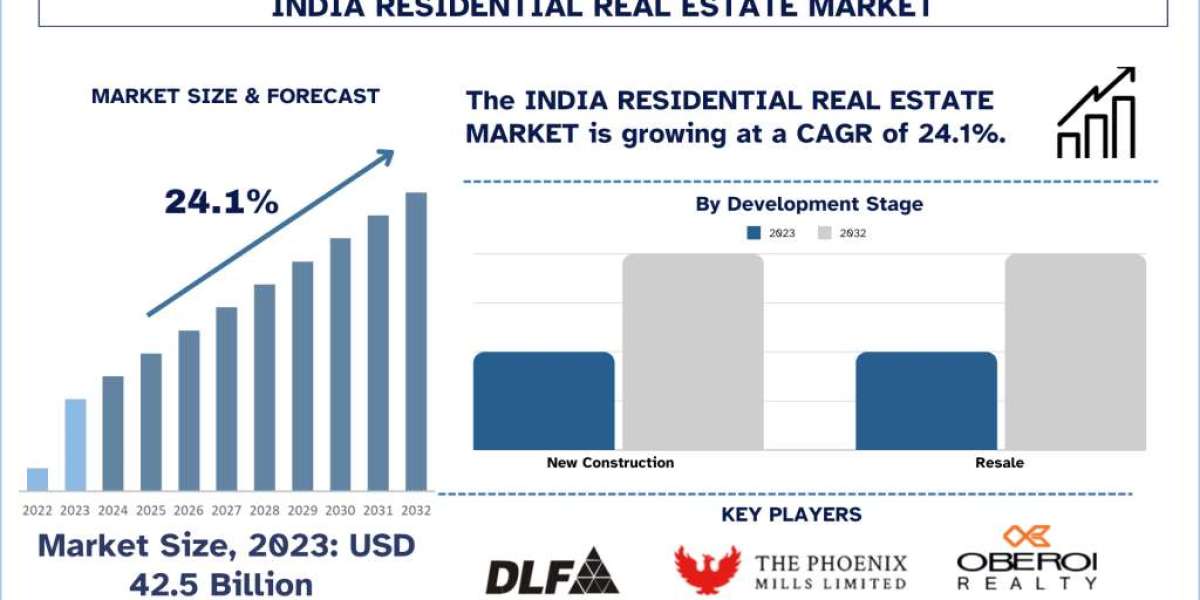

According to a new report by Univdatos Market Insights, the India Residential Real Estate Market was valued at USD 42.5 billion in 2023 and is expected to grow at a strong CAGR of around 24.1% during the forecast period (2024-2032). The Indian residential real estate market is an active one and it is continuously growing due to factors such as urbanization, a rising middle-class population, and higher incidences of income. Major sections of the market include the affordable housing segment, especially in Tier 2 & Tier 3 cities; the Habitat segment has good demand due to government policies like Pradhan Mantri Awas Yojana. Therefore, there is a variety of developers ranging from leading companies as well as small newly formed companies to satisfy the diverse needs of the buyers. Measures are improving transnationality and boosting technological solutions, while the problems of sustainable development contribute to adopting environmentally friendly construction solutions.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=68064

KEY GROWTH DRIVERS:

The Indian residential real estate sector is fast growing due to influential social forces, including growing urbanization, economic liberalization, and policies. The Country has an approximately 1.4 billion population and a large number of populations have migrated to urban areas for living purposes, thus the requirement for both commercial and residential buildings is increasing especially in metro cities and growing secondary and tier three cities. The market has shifted a step further towards the affordable housing segment due to a priming policy based on the government’s housing. Also, trends concerning smart homes and environmentally friendly buildings are becoming common since landlords are considering modern things like automation and sustainability.

· In October 2024, Realty firm Godrej Properties won a bid to acquire 7.5 acres of land in Gurugram to develop a luxury housing project with a revenue potential of more than Rs 5,500 crore.

· In July 2024, Realty major DLF announced to launch of a nearly 37 million square feet area for sale in the medium term across various cities with a revenue potential of Rs 1.04 lakh crore as part of its strategy to encash strong demand for luxury homes. In its latest investor presentation for the April-June quarter, DLF informed about the “planned launches of Rs 1+ lakh crore (36 million square feet) of new products over the medium term”.

The report suggests that Rapid Urbanization is a significant factor driving the growth of the residential real estate market in the coming years. Among all the factors urbanization can be mentioned as the key factor shaping the demand for residential real estate in India and which drastically changed the situation with the housing all over the country. With the economic growth of the country, a massive relocation from rural areas to urban centers has been realized as people and families in search of better jobs, better education, and better living standards. This factor alone suggests that by 2031, the provision of adequate and affordable housing to house more than 600 Million people in the increasingly urban India is a major need. Metropolitan areas including Mumbai, Delhi, Bengaluru, and Chennai have seen a population increase causing pressure on available infrastructure and resulting in many housing projects. This kind of urban migration is not just a numbers game, there is more to it, including lifestyle changes and preferences. Specifically, the under-35 generation of workers is embracing the idea of moving to urban centers due to attractive social life, good infrastructure, and accessibility. For this reason, there is an upward tendency in the development of all forms of residential units including apartment buildings, gated estates, etc. suited for all classes of people. The Indian government has woken up to this reality, and there is an agenda to promote urban development as evidenced by the Smart Cities Mission aimed at building a sustainable urban ecosystem. Moreover, programs and goals such as Pradhan Mantri Awas Yojana (PMAY) which aims at increasing affordable housing for low to middle-income groups are highly relevant because many developing cities have a severe housing demand. Concisely, urbanization is not the shift of people from rural to urban areas however it is the very force that is influencing and will continue to influence the residential real estate market of India in future years.

Independent Houses and Villas SegmentGaining Maximum Traction in the Market

Independent Houses and Villas have emerged as one of the fastest-growing categories in India’s residential real estate due to the evolving customers’ tendencies towards quarantine and separated comfortable residence spaces. More and more, customers are learning the value of privacy, outdoor living, and community living, especially in the aftermath of the pandemic, which pushed many away from densely populated cities. This is especially true in the sub-urban and peri-urban areas where the cost of housing can easily be afforded. To meet this challenge developers are beginning to design new projects as highly secured exclusive estates with essential comforts and accessories. Consequently, the Independent Houses and Villas segment has developed the right opportunity for further growth to attract customers for the betterment of long-term investments and enriched living standards.

Explore the comprehensive research on report here:- https://univdatos.com/report/india-residential-real-estate-market/

Conclusion

In conclusion, the Indian residential real estate market is expected to sustain its growth more in the future as the population gets urbanized and as the middle-income population grows and becomes more educated and sensitive to newer trends. Theoretically, underlying segments such as affordable housing, self-employed houses, villas, and the new favorite – online marketplace, are all establishing themselves in terms of the new demands of the customers. Even more, government drives and policies are also supporting its investment environment and technological evolutions are also promoting transparency and effectiveness of the transactions.

Related Building Material and Construction Research Report

Medium Density Fiberboard Market: Current Analysis and Forecast (2024-2032)

Middle East Real Estate Market: Current Analysis and Forecast (2023-2030)

MENA Green Building Materials Market: Current Analysis and Forecast (2023-2030)

Middle East Green Cement Market: Current Analysis and Forecast (2023-2030)

Concrete Admixtures Market: Current Analysis and Forecast (2023-2030)

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website - https://univdatos.com/

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/